Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Italy’s FMCG (Fast-Moving Consumer Goods) market is witnessing a sharp digital transformation, with major retailers like Coop and Esselunga investing heavily in e-commerce and omnichannel retail experiences. As online competition intensifies, brands are turning to advanced analytics and web data scraping to decode pricing trends, shelf visibility, and promotional performance.

Through Scrape FMCG Retail Data from Coop and Esselunga, businesses gain actionable insights into SKU-level competition, stock availability, and regional sales strategies. The Italian FMCG digital market saw an 18% surge in digital shelf competition between 2020 and 2025, driven by evolving consumer habits and the post-pandemic e-commerce boom.

This blog explores how FMCG brands, retailers, and data analysts can leverage scraping tools to extract real-time data from top Italian supermarket platforms, helping them make smarter, faster, and more profitable decisions.

The Italian FMCG industry has evolved dramatically with the shift toward online retail, convenience-based shopping, and subscription delivery models.

| Year | Italian FMCG E-commerce Market Value (€ Billion) | YoY Growth |

|---|---|---|

| 2020 | 2.8 | - |

| 2021 | 3.5 | +25% |

| 2022 | 4.1 | +17% |

| 2023 | 4.8 | +17% |

| 2024 | 5.3 | +10% |

| 2025* | 6.1 | +15% |

From 2020 to 2025, FMCG e-commerce in Italy grew by 117%, driven by convenience-based digital ordering and mobile-first shoppers. Platforms like Coop and Esselunga dominate over 40% of Italy’s online grocery market.

By deploying Extract FMCG Data from Coop and Esselunga Online Stores, Actowiz Metrics identified price fluctuations of up to 22% across categories like dairy, packaged snacks, and personal care during promotional periods—offering brands crucial insights into dynamic retail behavior.

FMCG retail competition has moved beyond store aisles to digital shelves, where search ranking, visibility, and discount timing determine success.

| Metric | 2020 | 2025 | Growth |

|---|---|---|---|

| Average Weekly Price Change | 3.2% | 6.8% | +112% |

| Product Promotions per Category | 12 | 24 | +100% |

| Visibility Competition (Top 10 Brands) | 65% | 83% | +18% |

Brands now fight for online visibility through algorithmic placement, digital ads, and pricing precision. Coop and Esselunga’s product catalogs show that real-time pricing updates and smart promotions directly influence purchase intent.

Using Web Scraping Coop & Esselunga FMCG Product Data, Actowiz Metrics helped FMCG brands identify top-performing categories and seasonal pricing trends, improving shelf visibility by 20% and optimizing promotions to boost ROI.

Between 2020 and 2025, Italian consumers have become more health-conscious, sustainability-focused, and digitally connected.

| Category | Market Share (2020) | Market Share (2025) | Trend |

|---|---|---|---|

| Health & Organic Foods | 18% | 27% | +9% |

| Beverages & Dairy | 22% | 25% | +3% |

| Packaged Goods | 30% | 28% | -2% |

| Personal Care | 15% | 18% | +3% |

| Household Supplies | 15% | 14% | -1% |

The rise of organic and local product demand reshaped Coop and Esselunga’s online assortments. Health-focused SKUs have increased 35% since 2021.

By implementing Coop and Esselunga Product Data Scraping for Market Insights, Actowiz Metrics revealed emerging subcategories like plant-based proteins and eco-friendly packaging driving double-digit growth. These data-backed insights help retailers fine-tune assortments for evolving consumer preferences.

Consumer behavior in Italy varies significantly by region due to income levels, cultural preferences, and delivery infrastructure.

| Region | E-commerce Adoption (2025) | Top FMCG Category | Avg. Basket Value (€) |

|---|---|---|---|

| Northern Italy | 82% | Fresh Produce | 68 |

| Central Italy | 74% | Beverages | 59 |

| Southern Italy | 61% | Packaged Goods | 53 |

Northern regions, led by Milan and Turin, dominate online grocery adoption. Coop’s online orders in Lombardy grew by 26% YoY, while Esselunga’s mobile app transactions doubled.

By leveraging FMCG Retail Data Extraction from Coop and Esselunga, Actowiz Metrics helped brands identify underperforming zones and optimize delivery routes, reducing logistics costs by 14%. Regional data scraping also enabled location-based discounting strategies, improving conversion rates in price-sensitive markets.

Between 2020 and 2025, promotions became the key differentiator for FMCG retailers, especially around events like Black Friday and Easter.

| Promotion Type | Share in Total Discounts (2025) | Avg. Discount (%) |

|---|---|---|

| Buy-One-Get-One (BOGO) | 32% | 24 |

| Flash Sales | 27% | 18 |

| Loyalty Points | 19% | 12 |

| Price Drops | 22% | 15 |

Esselunga uses personalized promotions for loyalty app users, while Coop emphasizes eco-label product discounts.

Through Scrape FMCG Retail Data from Coop and Esselunga, Actowiz Metrics enabled FMCG companies to track competitor promotions across 50+ categories in real time, identifying an average 18% gap between retail and brand-offered discounts—an insight crucial for margin control and price optimization.

Digital shelf analytics determine product performance in online stores. From placement rank to image quality, every detail impacts conversion.

| Digital Metric | 2020 Avg. Score | 2025 Avg. Score | Improvement |

|---|---|---|---|

| Product Visibility Score | 68 | 81 | +19% |

| Description Completeness | 75 | 88 | +17% |

| Image Optimization | 63 | 85 | +22% |

| Mobile Search Performance | 70 | 86 | +16% |

Brands that consistently optimize product pages outperform competitors by 23% in conversion rate.

Using Scrape FMCG Retail Data from Coop and Esselunga, Actowiz Metrics assisted brands in enhancing content quality, ensuring accurate product metadata, and improving digital shelf positioning to achieve higher organic visibility and engagement.

The Italian online grocery market is projected to reach €8.5 billion by 2027, driven by mobile-first consumers and AI-driven personalization. Coop plans to expand express delivery in 50 more cities, while Esselunga is investing in data-backed dynamic pricing models.

| Year | Projected Market Value (€ Billion) | Mobile Orders Share |

|---|---|---|

| 2025 | 6.1 | 68% |

| 2026 | 7.2 | 71% |

| 2027 | 8.5 | 75% |

With increasing digital penetration, brands that integrate automation and real-time analytics into their retail operations will gain a strong edge.

By employing Web Scraping Coop & Esselunga FMCG Product Data, Actowiz Metrics helps retailers adapt to rapid market evolution, predict trends, and optimize digital shelf efficiency through precise, clean data.

Actowiz Metrics empowers FMCG brands and retailers with advanced Grocery Analytics solutions designed to decode pricing, availability, and promotional insights from online stores. Our data-driven tools provide real-time dashboards for Product Data Tracking, helping teams compare prices, analyze promotions, and measure category-level competitiveness.

We specialize in structured data extraction from complex FMCG websites and mobile apps, ensuring accuracy, scalability, and compliance—turning unstructured retail data into actionable intelligence for marketing and supply chain optimization.

As Coop and Esselunga lead Italy’s digital grocery transformation, brands must stay data-ready to compete effectively. Actowiz Metrics combines Brand Competition Analysis and Pricing and Promotion intelligence to deliver precise, actionable insights that power growth.

Stay ahead of Italy’s fast-changing FMCG landscape—partner with Actowiz Metrics for real-time retail intelligence and smarter market strategy.

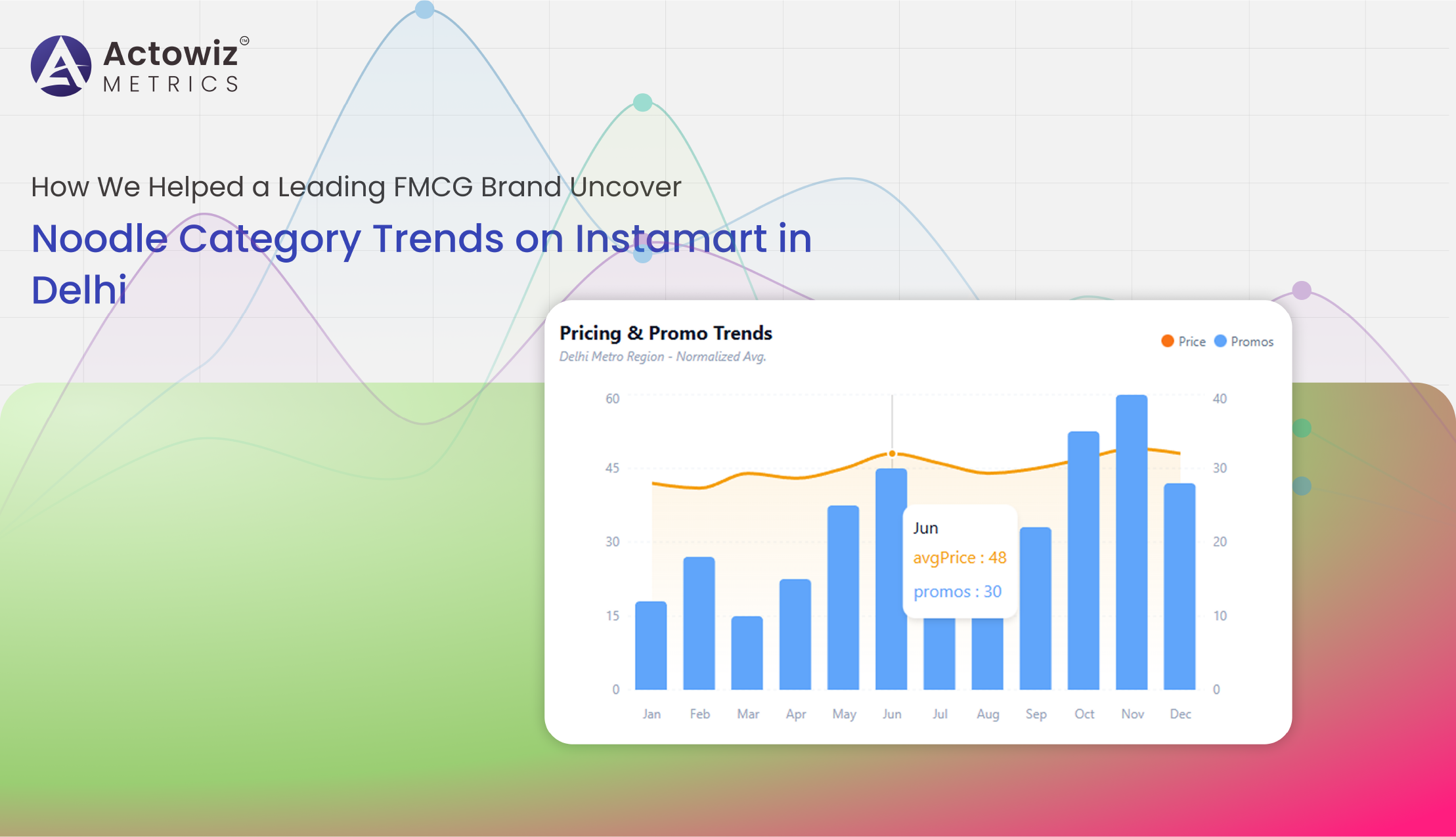

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

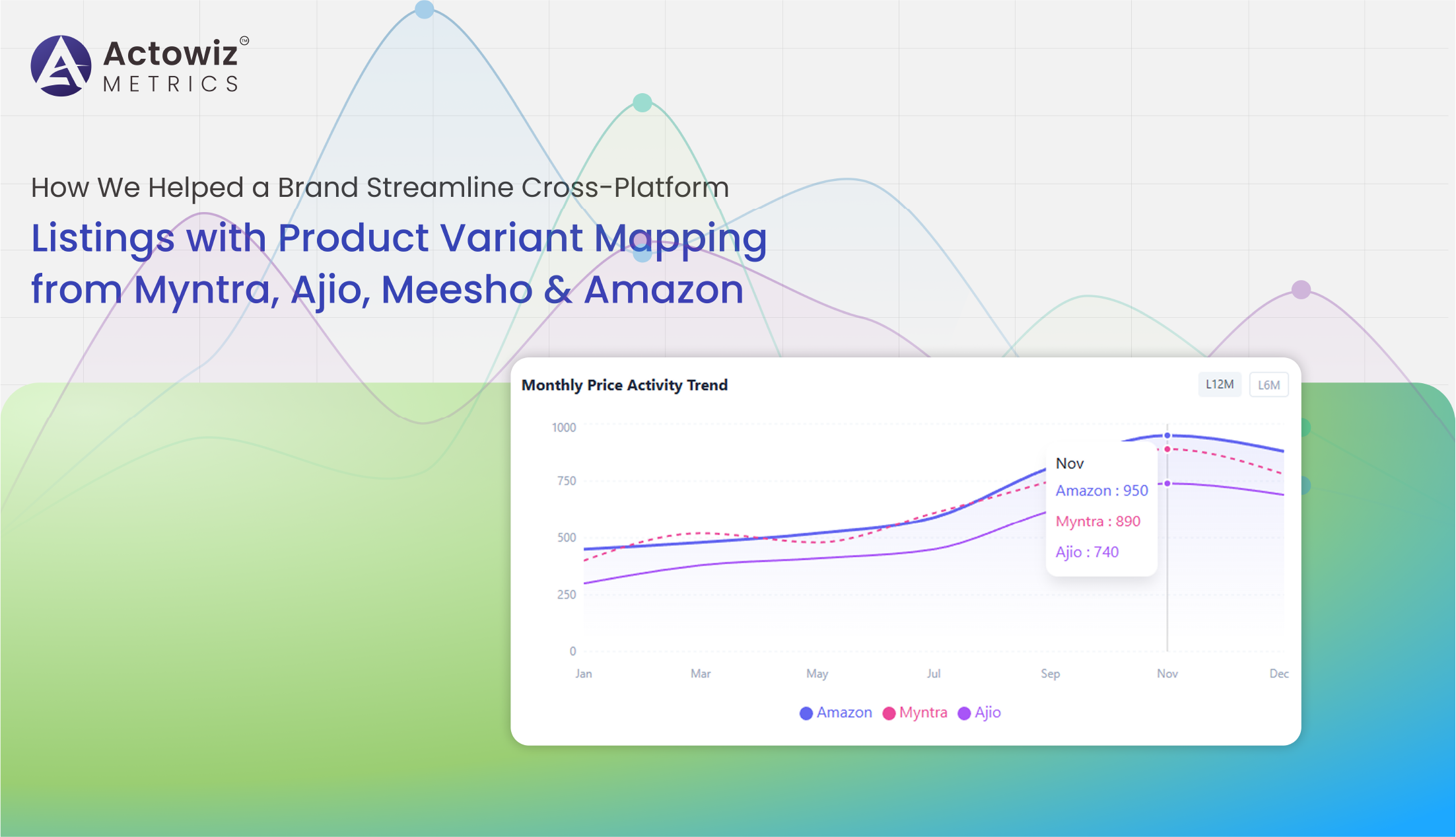

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

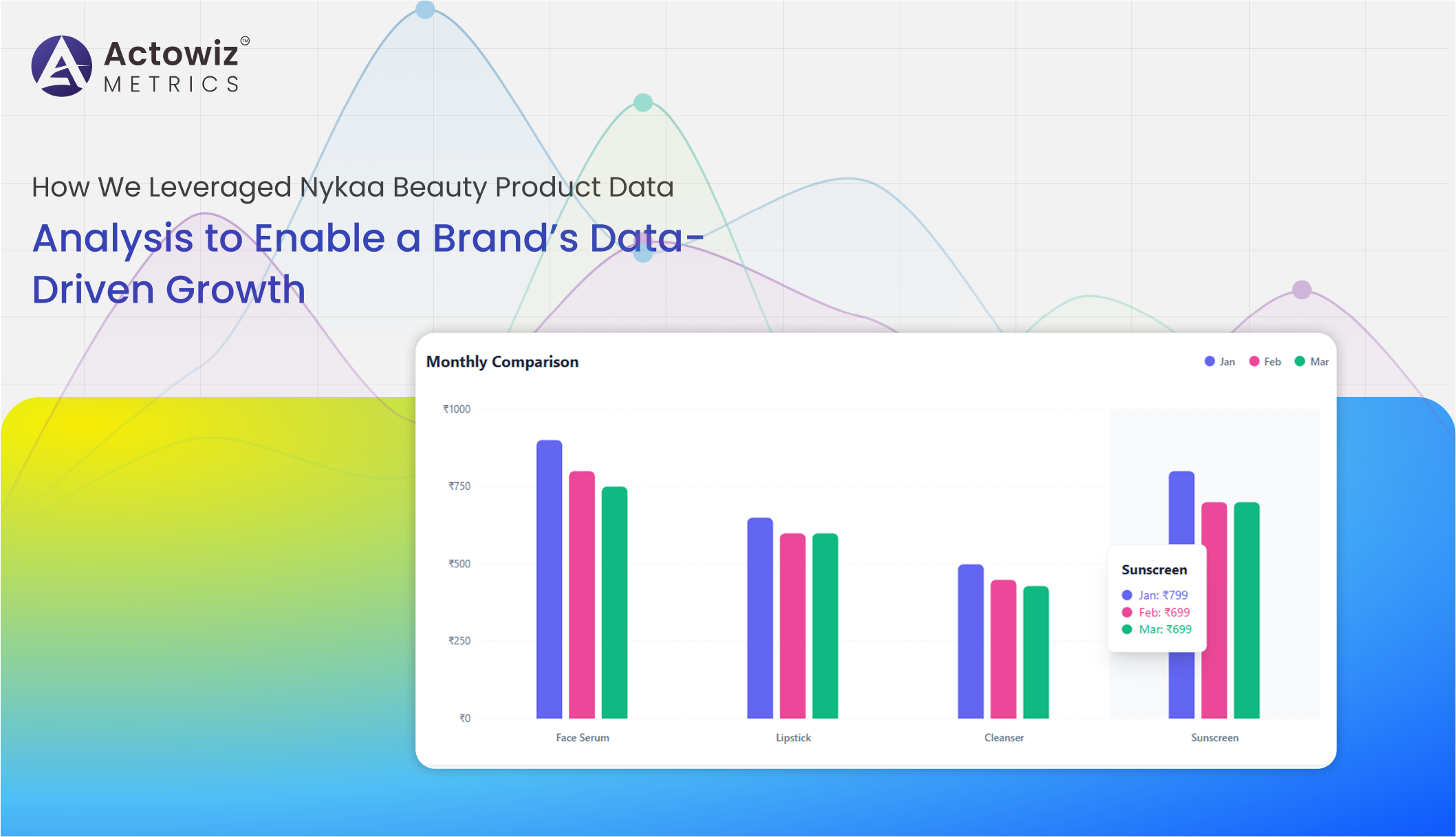

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

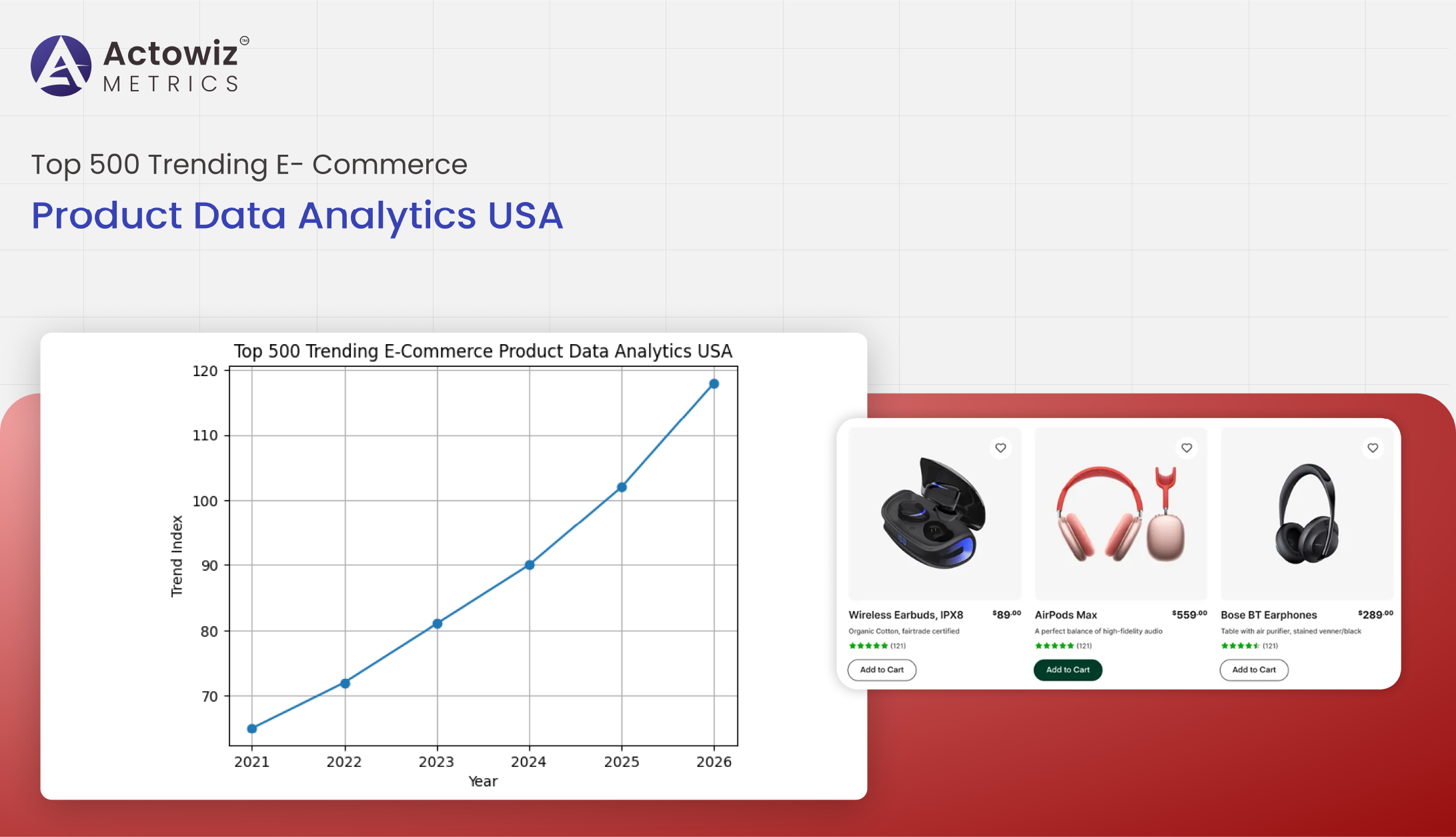

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

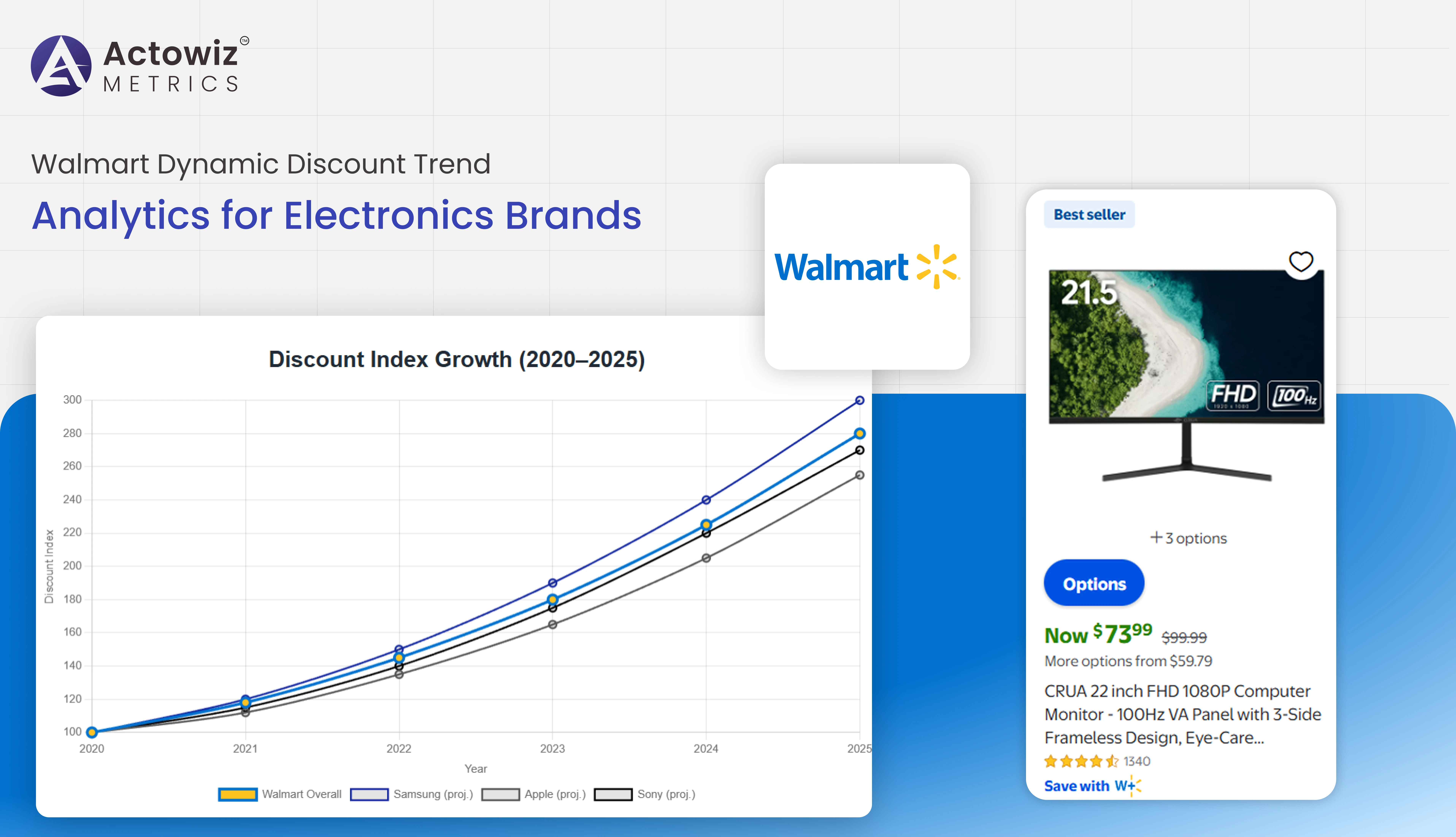

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

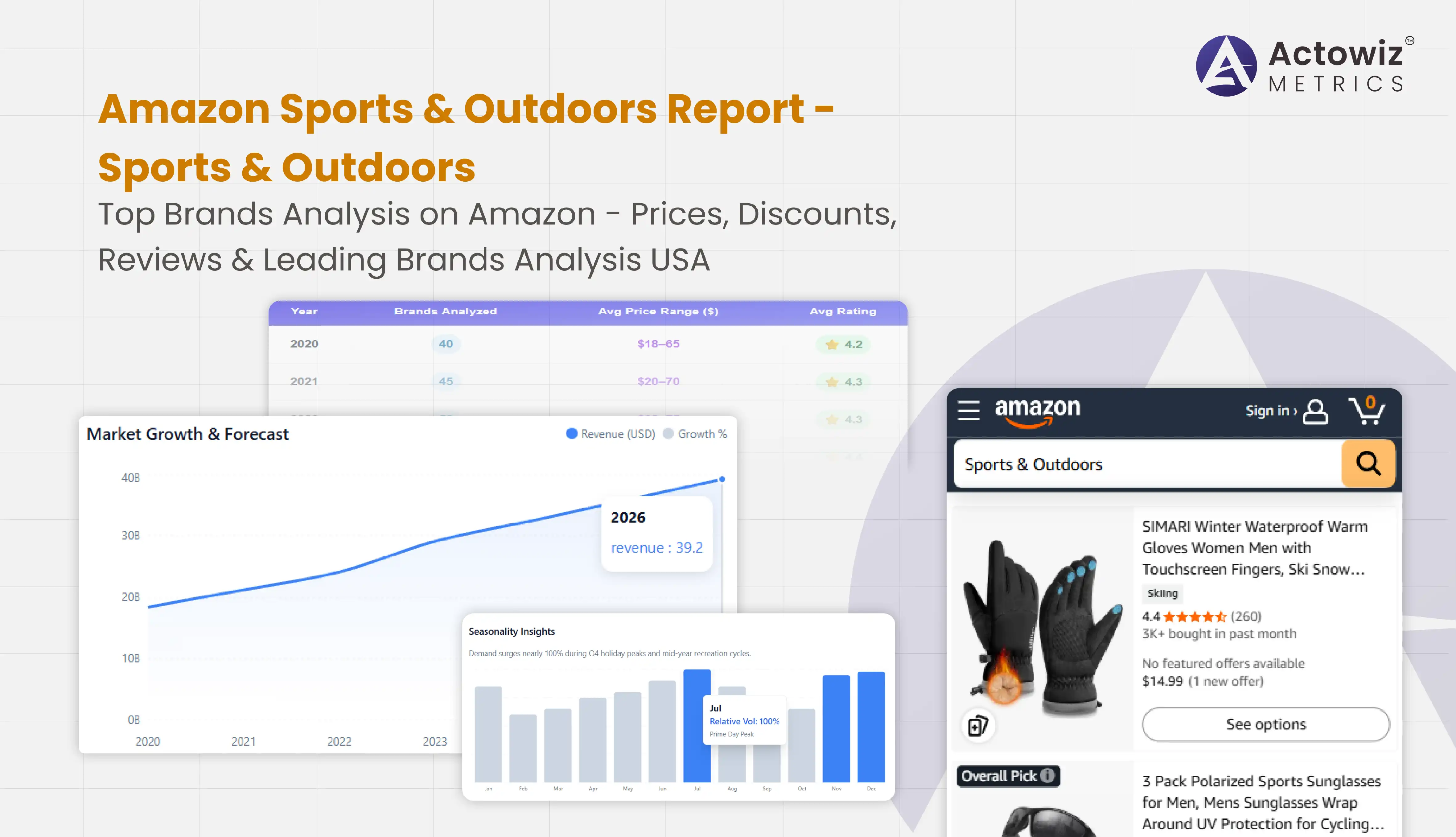

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals