Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

The Munich FMCG market is highly competitive, with leading retailers like Lidl, Aldi, and Carrefour constantly vying for market share. Understanding pricing, promotions, and product availability across these chains is essential for retailers, suppliers, and analysts. Traditional market monitoring is time-consuming and often incomplete, making it difficult to gain actionable insights. With Scrape Lidl vs Aldi vs Carrefour FMCG data in Munich, businesses can systematically track SKUs, pricing trends, and online stock levels across all three retailers. By integrating Lidl vs Aldi vs Carrefour pricing comparison, organizations can benchmark product prices and identify promotional opportunities to optimize their sales strategies. Additionally, Scrape Lidl category listings and SKUs ensures detailed visibility into product assortment, enabling better inventory planning and demand forecasting. Using Lidl vs Aldi vs Carrefour grocery product analytics, stakeholders can track product launches, seasonal trends, and category performance to make data-driven decisions. This blog explores how automated scraping and analytics help navigate Munich’s dynamic FMCG landscape.

Between 2020 and 2025, Lidl, Aldi, and Carrefour have maintained competitive pricing strategies to attract price-sensitive consumers. By using Scrape Lidl vs Aldi vs Carrefour FMCG data in Munich, analysts can track historical price changes, promotions, and discount patterns to understand pricing behavior.

| Year | Lidl Avg Price (€) | Aldi Avg Price (€) | Carrefour Avg Price (€) |

|---|---|---|---|

| 2020 | 3.25 | 3.15 | 3.40 |

| 2021 | 3.30 | 3.20 | 3.45 |

| 2022 | 3.35 | 3.25 | 3.50 |

| 2023 | 3.40 | 3.30 | 3.55 |

| 2024 | 3.45 | 3.35 | 3.60 |

| 2025 | 3.50 | 3.40 | 3.65 |

Using Aldi price monitoring via web scraping, retailers can identify seasonal price fluctuations and adjust promotional strategies. Real-time Product Availability Analytics allows teams to track which products are in stock and compare pricing across competitors, ensuring optimized pricing decisions for maximum ROI.

Monitoring stock levels across Lidl, Aldi, and Carrefour is critical for understanding supply-demand dynamics. By employing Scrape Lidl vs Aldi vs Carrefour FMCG data in Munich, businesses can track SKU availability and detect stock-outs in real time. Extract Aldi grocery product listings data enables analysts to understand category trends and identify potential inventory gaps. Similarly, Scrape Carrefour online stock availability provides insight into regional availability across Munich outlets.

| Year | Lidl Avg Stock (%) | Aldi Avg Stock (%) | Carrefour Avg Stock (%) |

|---|---|---|---|

| 2020 | 92 | 90 | 88 |

| 2021 | 93 | 91 | 89 |

| 2022 | 94 | 92 | 90 |

| 2023 | 94 | 92 | 91 |

| 2024 | 95 | 93 | 92 |

| 2025 | 95 | 93 | 93 |

With advanced grocery analytics, FMCG suppliers can track demand trends, forecast stock requirements, and identify fast-moving SKUs across all three retailers.

By leveraging Scrape Lidl category listings and SKUs, analysts gain detailed visibility into product segmentation and category performance. Between 2020 and 2025, categories like packaged foods, beverages, and fresh produce showed varying growth rates across Lidl, Aldi, and Carrefour. Lidl vs Aldi vs Carrefour grocery product analytics allows companies to identify which categories are performing best, which are underrepresented, and which SKUs require promotional support.

| Category | Lidl Growth (%) | Aldi Growth (%) | Carrefour Growth (%) |

|---|---|---|---|

| Packaged Foods | 8 | 7 | 9 |

| Beverages | 6 | 5 | 7 |

| Fresh Produce | 10 | 9 | 11 |

| Snacks | 7 | 6 | 8 |

These insights inform product placement, marketing campaigns, and inventory management to maximize profitability.

Monitoring discounts and promotional campaigns is key for understanding competitive strategies. Lidl vs Aldi vs Carrefour pricing comparison allows businesses to track promotion frequency, discount depth, and product bundling trends. From 2020–2025, Lidl ran an average of 12 promotions per quarter, Aldi 10, and Carrefour 14. Pricing and Promotion analysis enables marketers to assess which promotional strategies drive higher sales and improve market share.

| Year | Lidl Avg Discounts (%) | Aldi Avg Discounts (%) | Carrefour Avg Discounts (%) |

|---|---|---|---|

| 2020 | 15 | 14 | 16 |

| 2021 | 16 | 14 | 17 |

| 2022 | 17 | 15 | 18 |

| 2023 | 18 | 16 | 19 |

| 2024 | 18 | 16 | 20 |

| 2025 | 19 | 17 | 21 |

Real-time data allows dynamic pricing adjustments and optimized campaign strategies across multiple locations.

Tracking individual SKUs across retailers is essential to identify performance trends. Using Scrape Lidl vs Aldi vs Carrefour FMCG data in Munich, businesses can monitor stock-outs, top-selling products, and SKU rotation. Extract Aldi grocery product listings data and Scrape Carrefour online stock availability further enrich SKU-level intelligence.

| SKU Type | Lidl Stock Turns | Aldi Stock Turns | Carrefour Stock Turns |

|---|---|---|---|

| Packaged Food | 6 | 5 | 6 |

| Beverage | 5 | 4 | 5 |

| Fresh Produce | 8 | 7 | 8 |

This granular view supports inventory optimization, demand forecasting, and effective category management.

By analyzing store-level data from multiple Munich locations, retailers can identify geographic trends and high-performing stores. Scrape Lidl vs Aldi vs Carrefour FMCG data in Munich provides insights into regional demand, stock availability, and promotional effectiveness. Lidl vs Aldi vs Carrefour grocery product analytics helps marketers allocate resources, plan regional campaigns, and optimize pricing for maximum competitiveness.

| District | Top Store Performance | Avg Engagement (Sales Units) |

|---|---|---|

| Innenstadt | Lidl | 15,000 |

| Schwabing | Aldi | 12,500 |

| Maxvorstadt | Carrefour | 14,000 |

| Bogenhausen | Lidl | 13,500 |

These insights guide data-driven decision-making and operational efficiency.

Forecasting FMCG trends is vital for staying competitive. By combining historical data from 2020–2025 via Scrape Lidl vs Aldi vs Carrefour FMCG data in Munich, marketers can predict SKU demand, pricing trends, and promotional effectiveness. Lidl vs Aldi vs Carrefour pricing comparison allows businesses to make proactive strategic decisions, optimize assortment, and plan campaigns.

| Metric | 2025 Value | 2026 Forecast | 2027 Forecast |

|---|---|---|---|

| Avg Price per SKU (€) | 3.50 | 3.55 | 3.60 |

| Avg Stock Availability (%) | 95 | 96 | 96.5 |

| Avg Promotion Rate (%) | 19 | 20 | 21 |

Predictive insights ensure higher sales, reduced stock-outs, and improved ROI.

Actowiz Metrics provides automated solutions to Scrape Lidl vs Aldi vs Carrefour FMCG data in Munich, enabling retailers and suppliers to access real-time pricing, stock, and promotion data. Using Lidl vs Aldi vs Carrefour grocery product analytics, businesses gain SKU-level insights, track competitor strategies, and benchmark performance across Munich. Our Aldi price monitoring via web scraping and Scrape Carrefour online stock availability tools deliver actionable intelligence for dynamic pricing, promotional planning, and inventory optimization. With advanced grocery analytics and Product Availability Analytics, stakeholders can make data-driven decisions, forecast demand, and enhance operational efficiency. Automated extraction ensures consistent, accurate, and scalable insights across thousands of SKUs, helping FMCG businesses maintain a competitive edge in Munich’s retail landscape.

The Munich FMCG market is fiercely competitive, and staying ahead requires timely insights into pricing, product availability, and promotions. By leveraging Scrape Lidl vs Aldi vs Carrefour FMCG data in Munich, businesses can monitor SKUs, compare prices, and track regional trends effectively. Combining Lidl vs Aldi vs Carrefour pricing comparison, Scrape Lidl category listings and SKUs, and Lidl vs Aldi vs Carrefour grocery product analytics provides a 360-degree view of the market. Real-time analytics supports strategic decision-making, operational efficiency, and optimized marketing campaigns. Actowiz Metrics empowers FMCG players to harness actionable intelligence, predict demand, and gain a competitive advantage. Transform your retail strategy with advanced web scraping and data analytics to stay ahead in Munich’s dynamic FMCG landscape.

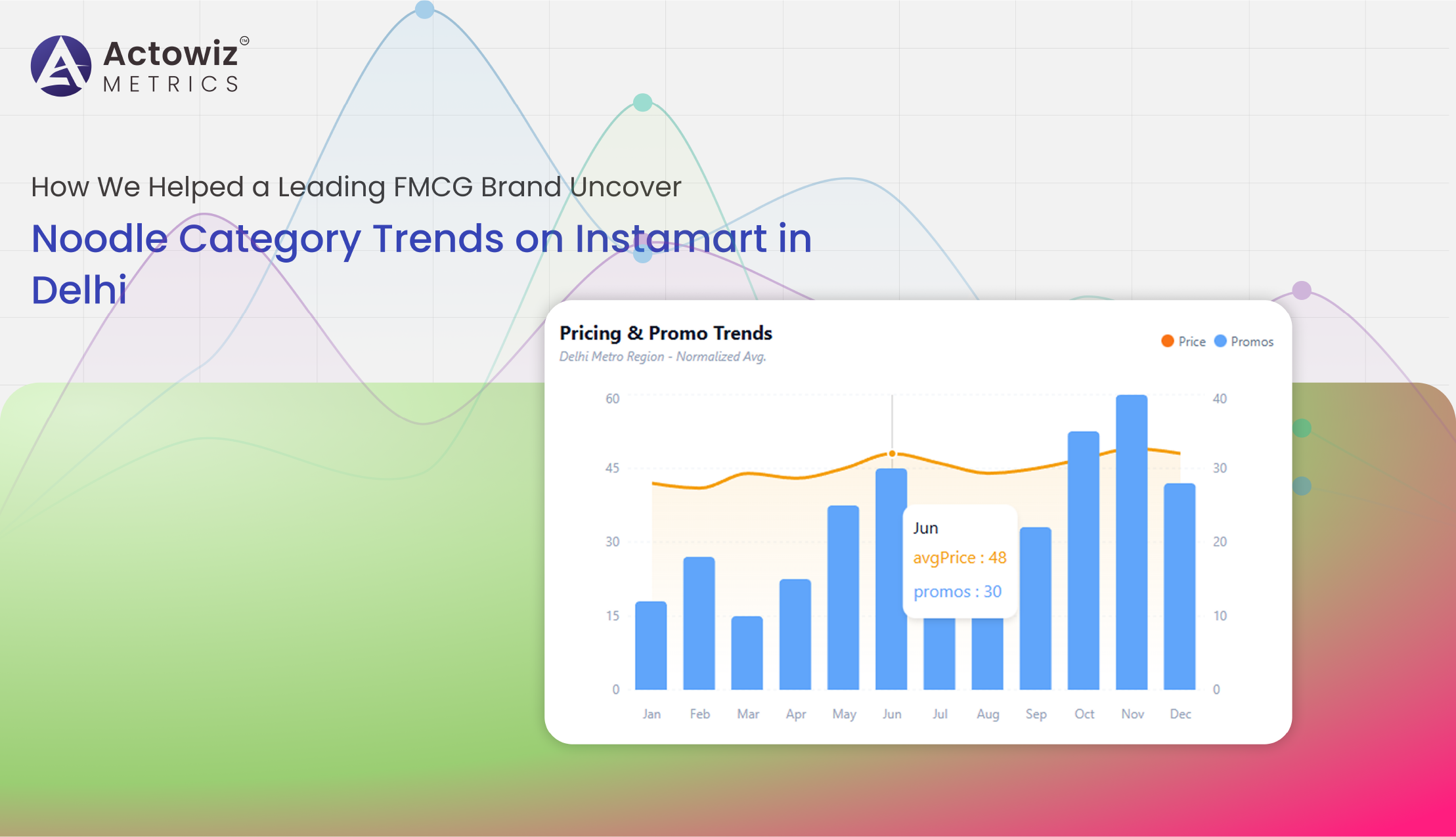

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

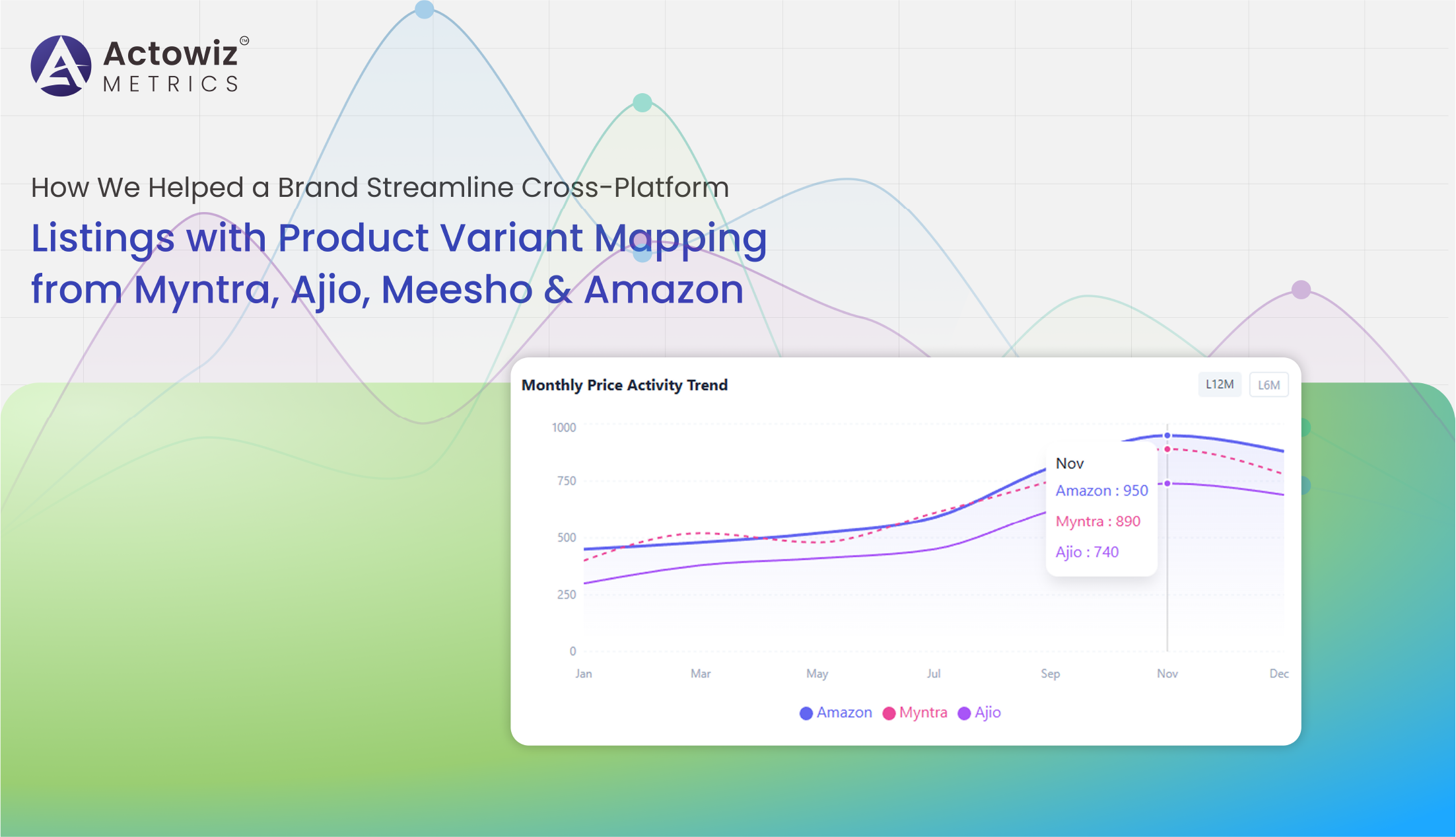

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

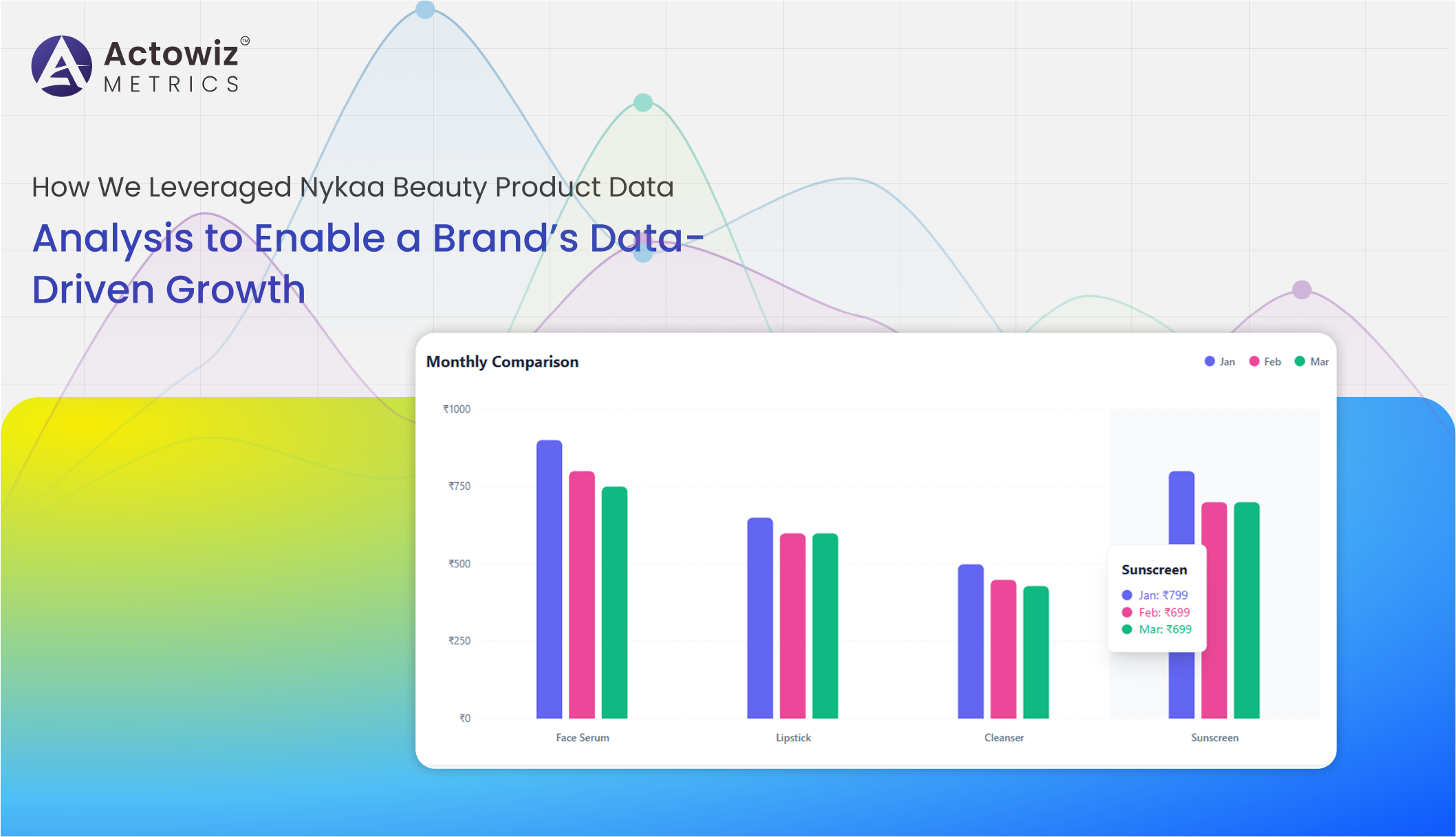

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

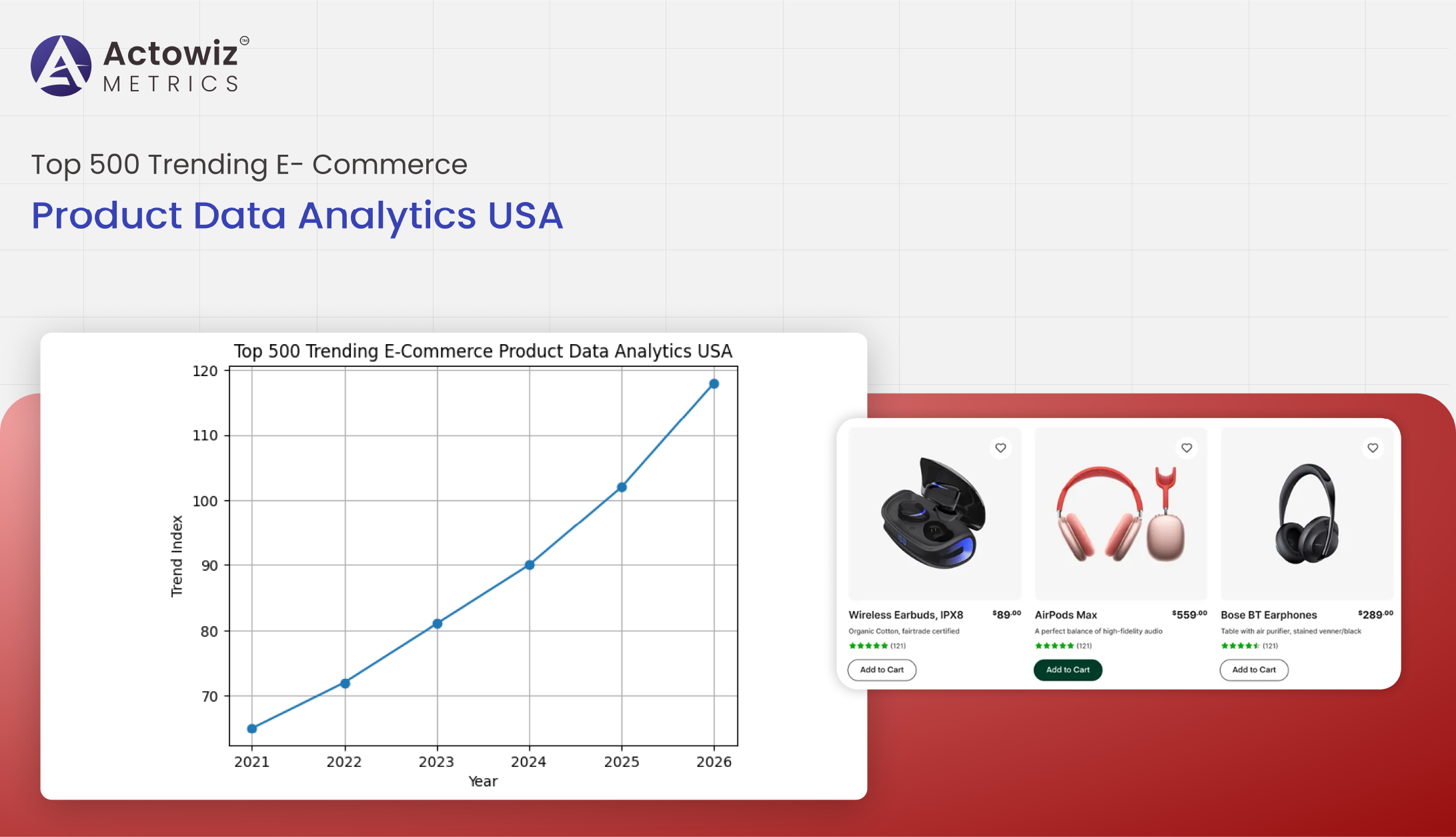

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

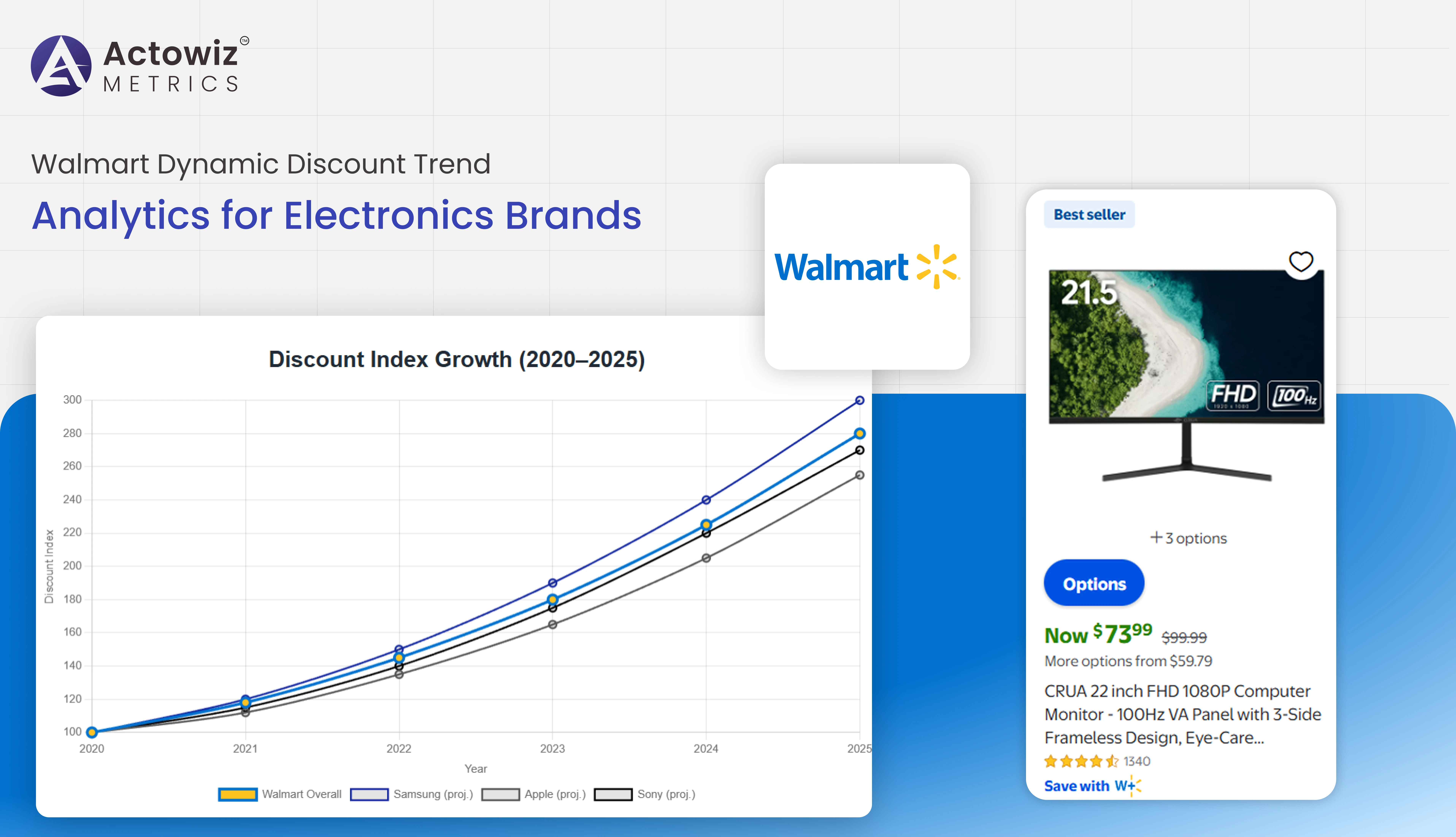

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

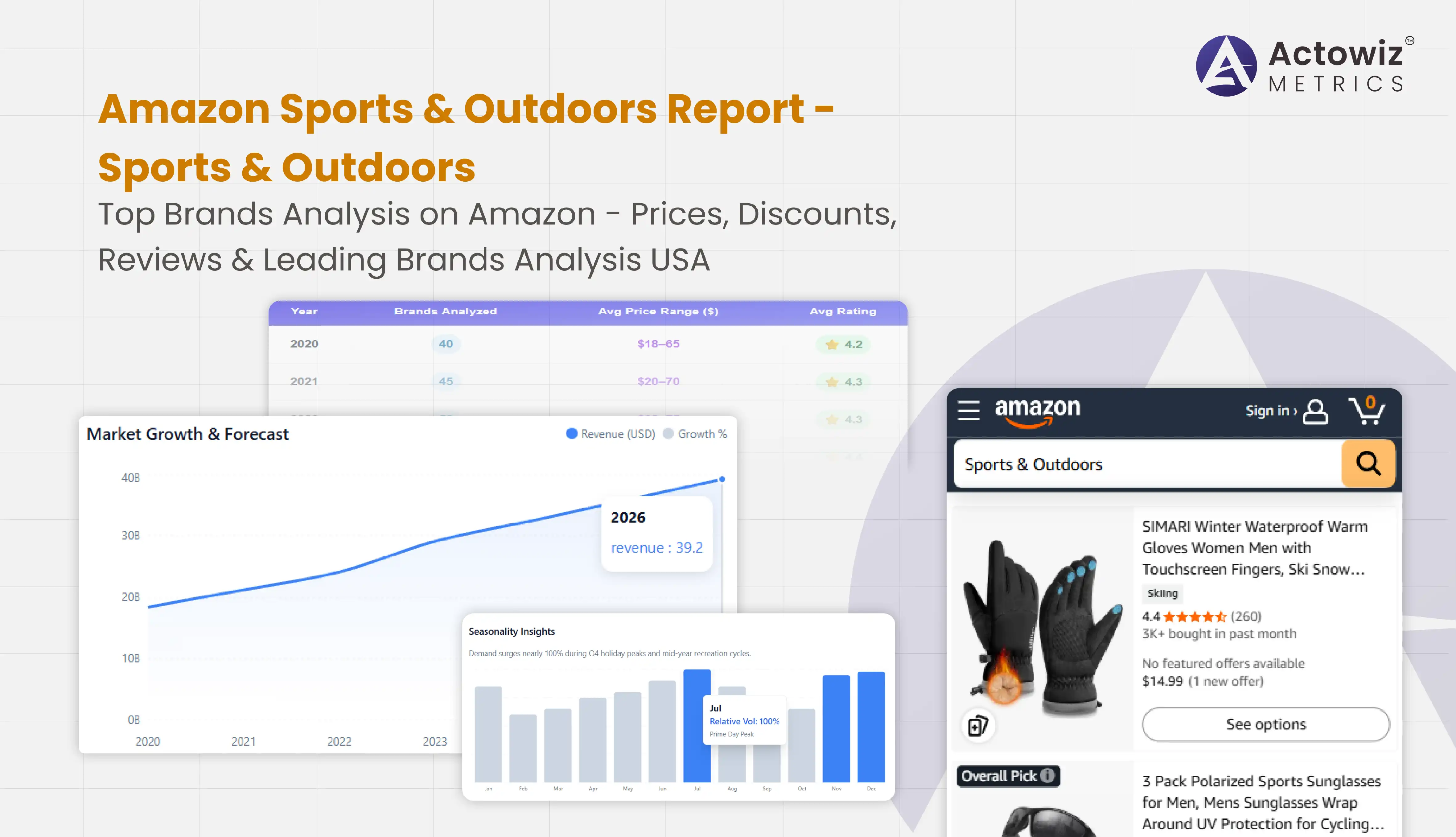

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals