Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

In today’s competitive UK grocery market, pricing strategy and promotions play a pivotal role in attracting and retaining customers. With increasing consumer sensitivity to price changes, businesses need actionable insights to remain competitive. Leveraging grocery analytics, retailers can analyze real-time trends, compare competitor pricing, and optimize shelf strategy.

Weekly price scraping from Tesco & ASDA provides a comprehensive solution for tracking thousands of products across multiple categories, capturing discounts, promotions, and price variations. By automating the data collection process, retailers can eliminate manual errors and ensure real-time updates.

Using weekly grocery price scraping UK and Tesco pricing data extraction UK, businesses can evaluate the effectiveness of promotions, optimize pricing strategy, and maintain competitive advantage. web scraping UK grocery data enables monitoring of both online and in-store pricing, ensuring a holistic view of the market. Combined with Tesco vs ASDA weekly pricing analysis, companies can gain insights into pricing trends, promotional success, and basket-level dynamics.

Weekly price scraping from Tesco & ASDA empowers businesses to make informed decisions, optimize revenue, and respond rapidly to market changes. Tools like Tesco & ASDA shelf price scraping and real-time grocery pricing insights UK help retailers transform raw pricing data into actionable intelligence.

Promotions are a key driver of sales in the UK grocery market. Using weekly price scraping from Tesco & ASDA, retailers can track weekly offers, discounts, and special pricing across thousands of SKUs. Historical data from 2020 to 2025 demonstrates clear trends in promotional activity:

| Year | Promotions Tracked | Avg Discount (%) | Products on Offer | Revenue Impact (%) |

|---|---|---|---|---|

| 2020 | 5,000 | 12% | 10,000 | 8% |

| 2021 | 6,000 | 13% | 12,000 | 10% |

| 2022 | 7,500 | 14% | 15,000 | 12% |

| 2023 | 8,500 | 15% | 17,000 | 15% |

| 2024 | 9,500 | 16% | 20,000 | 18% |

| 2025 | 11,000 | 17% | 22,500 | 20% |

By combining Tesco grocery analytics and ASDA grocery data analytics, retailers can understand which promotions drive volume and which fail to deliver ROI. Scrape Tesco and ASDA hyperlocal grocery prices to monitor localized promotions and tailor campaigns for specific regions.

Integrating data into a Tesco vs ASDA price comparison dashboard allows for side-by-side analysis of promotional effectiveness. Businesses can identify patterns such as seasonal discounts, competitor matching, and high-performing SKUs.

Through weekly price scraping from Tesco & ASDA, teams gain real-time visibility into pricing strategy and promotional trends, ensuring quicker adjustments and more effective campaigns. By leveraging structured pricing data, retailers can increase promotional efficiency and revenue impact by up to 20% over five years.

Consumers increasingly seek competitive pricing at a local level. Weekly price scraping from Tesco & ASDA enables hyperlocal tracking, capturing pricing variations between stores and regions. Data from 2020–2025 shows substantial differences in basket-level pricing:

| Year | Stores Monitored | Avg Basket Price (£) | Regional Price Variance (%) | Savings Identified (£) |

|---|---|---|---|---|

| 2020 | 200 | 45 | 5% | 2 |

| 2021 | 250 | 46 | 5.5% | 2.5 |

| 2022 | 300 | 47 | 6% | 3 |

| 2023 | 350 | 48 | 6.5% | 3.5 |

| 2024 | 400 | 49 | 7% | 4 |

| 2025 | 450 | 50 | 7.5% | 4.5 |

Tesco vs ASDA grocery basket analytics provides insights into which stores offer the most competitive pricing for common grocery baskets. By leveraging real-time grocery pricing insights UK, businesses can optimize regional promotions, plan dynamic pricing, and identify market opportunities.

Hyperlocal insights also support competitive benchmarking. Retailers can compare product availability, promotional strategies, and pricing efficiency between Tesco and ASDA across different regions. Integrating these insights into Tesco vs ASDA weekly pricing analysis ensures that pricing decisions are data-driven and timely.

This approach allows businesses to optimize pricing for local consumer preferences, increase basket size, and drive higher revenue. By adopting weekly price scraping from Tesco & ASDA, teams gain actionable insights that were previously impossible to achieve manually.

Monitoring weekly prices over time allows retailers to identify trends and forecast future pricing strategies. web scraping UK grocery data and historical data, businesses can predict which products are likely to be discounted, identify seasonal pricing patterns, and optimize inventory management:

| Year | Products Monitored | Avg Price (£) | Avg Weekly Change (%) | Forecast Accuracy (%) |

|---|---|---|---|---|

| 2020 | 5,000 | 1.20 | 0.5% | 85% |

| 2021 | 6,000 | 1.22 | 0.6% | 87% |

| 2022 | 7,500 | 1.25 | 0.7% | 88% |

| 2023 | 8,500 | 1.28 | 0.8% | 90% |

| 2024 | 9,500 | 1.30 | 0.9% | 92% |

| 2025 | 11,000 | 1.32 | 1.0% | 94% |

Tesco & ASDA shelf price scraping allows tracking of individual SKUs over time, revealing which products consistently go on promotion or experience price volatility. Integrating this with Tesco vs ASDA price comparison dashboard enables retailers to optimize promotional timing and pricing strategies.

Predictive insights from historical pricing, combined with weekly price scraping from Tesco & ASDA, help forecast future trends, reduce markdown losses, and improve inventory planning. Retailers can proactively adjust pricing and promotions based on reliable forecasts rather than reacting to competitors.

Retailers need to understand their position relative to competitors. Using Tesco vs ASDA weekly pricing analysis, businesses can monitor competitor promotions, price cuts, and product placement strategies:

| Year | Products Compared | Avg Price Gap (£) | Promotions Matched (%) | Revenue Impact (%) |

|---|---|---|---|---|

| 2020 | 5,000 | 0.10 | 50% | 5% |

| 2021 | 6,000 | 0.12 | 55% | 7% |

| 2022 | 7,500 | 0.15 | 60% | 10% |

| 2023 | 8,500 | 0.18 | 65% | 12% |

| 2024 | 9,500 | 0.20 | 70% | 15% |

| 2025 | 11,000 | 0.22 | 75% | 18% |

Scrape Tesco and ASDA hyperlocal grocery prices for competitor benchmarking, and combine it with Tesco grocery analytics and ASDA grocery data analytics for deeper insights. Benchmarking informs pricing, promotions, and inventory decisions to maintain competitive advantage.

Through weekly price scraping from Tesco & ASDA, businesses can identify gaps, capitalize on pricing mismatches, and improve overall market positioning. Historical data demonstrates measurable gains in revenue and promotion effectiveness when structured competitor data is leveraged.

Retailers often face challenges with pricing consistency between online and physical stores. Tesco & ASDA shelf price scraping provides visibility into in-store prices, ensuring accurate comparisons with online listings. Data from 2020–2025 reveals rising inconsistencies due to frequent promotional adjustments:

| Year | Stores Audited | Avg Price Mismatch (%) | Products Affected | Revenue Leakage (%) |

|---|---|---|---|---|

| 2020 | 200 | 2% | 1,000 | 3% |

| 2021 | 250 | 2.5% | 1,200 | 3.5% |

| 2022 | 300 | 3% | 1,500 | 4% |

| 2023 | 350 | 3.5% | 1,700 | 4.5% |

| 2024 | 400 | 4% | 2,000 | 5% |

| 2025 | 450 | 4.5% | 2,500 | 6% |

Through Tesco vs ASDA weekly pricing analysis, companies can address discrepancies and optimize shelf pricing strategies. Real-time insights allow teams to correct mismatches quickly, reducing revenue leakage.

Integrating Tesco vs ASDA grocery basket analytics helps evaluate consumer impact of pricing errors. Retailers can test corrective measures, optimize promotions, and improve compliance with pricing policies.

By adopting weekly price scraping from Tesco & ASDA, businesses can minimize mismatches, enhance trust with customers, and optimize shelf pricing to maximize profitability.

Understanding the consumer basket is crucial for optimizing promotions and pricing strategies. With Tesco vs ASDA grocery basket analytics, retailers can track how pricing affects purchasing behavior and basket composition.

Between 2020–2025, analysis shows shifting consumer preferences influenced by promotions:

| Year | Avg Basket Size (Items) | Avg Basket Spend (£) | Promo-driven Items (%) | Basket Growth (%) |

|---|---|---|---|---|

| 2020 | 25 | 45 | 20% | 3% |

| 2021 | 26 | 46 | 22% | 4% |

| 2022 | 27 | 47 | 24% | 5% |

| 2023 | 28 | 48 | 26% | 6% |

| 2024 | 29 | 49 | 28% | 7% |

| 2025 | 30 | 50 | 30% | 8% |

By combining Tesco grocery analytics with ASDA grocery data analytics, businesses can measure the impact of promotions on average basket size and spend. Using real-time grocery pricing insights UK, teams can adapt promotions in response to consumer demand.

Moreover, Tesco pricing data extraction UK and scrape Tesco and ASDA hyperlocal grocery prices ensure retailers optimize pricing for each region and demographic.

Through basket-level insights, businesses improve promotional ROI, maximize consumer loyalty, and strengthen market positioning with data-driven decision-making.

Actowiz Metrics specializes in delivering powerful retail and grocery data solutions through advanced web scraping technologies. By leveraging weekly price scraping from Tesco & ASDA, Actowiz provides real-time access to promotions, discounts, and competitor pricing at scale.

With expertise in Tesco vs ASDA weekly pricing analysis, our solutions empower retailers to monitor thousands of products weekly, gaining competitive insights and staying ahead in price wars. Using advanced pipelines, we offer real-time grocery pricing insights UK, covering both online and in-store product data.

Actowiz Metrics integrates tools like Tesco vs ASDA price comparison dashboard and Tesco vs ASDA grocery basket analytics, enabling clients to analyze promotions, monitor basket trends, and optimize shelf pricing. Additionally, we offer customized solutions for Tesco grocery analytics and ASDA grocery data analytics, ensuring businesses access granular insights tailored to their strategies.

By providing reliable, scalable, and clean datasets, Actowiz Metrics transforms unstructured grocery pricing data into actionable intelligence for retailers, suppliers, and e-commerce platforms.

In the ever-changing UK grocery market, success depends on accurate insights into pricing, promotions, and consumer behavior. Weekly price scraping from Tesco & ASDA equips businesses with real-time visibility into competitor strategies, helping optimize pricing, promotions, and basket-level insights. From Tesco & ASDA shelf price scraping to Tesco vs ASDA grocery basket analytics, structured datasets empower decision-making and drive measurable results.

With data-backed insights, retailers can reduce revenue leakage, enhance consumer loyalty, and maintain competitive advantage. The integration of tools like Tesco vs ASDA price comparison dashboard ensures executives have a clear, real-time view of market performance.

Actowiz Metrics enables businesses to harness the power of Tesco pricing data extraction UK, web scraping UK grocery data , and real-time grocery pricing insights UK, converting raw data into meaningful strategies.

Ready to transform your pricing and promotions strategy? Partner with Actowiz Metrics today to unlock the potential of real-time grocery data and stay ahead in the Tesco vs ASDA pricing war!

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

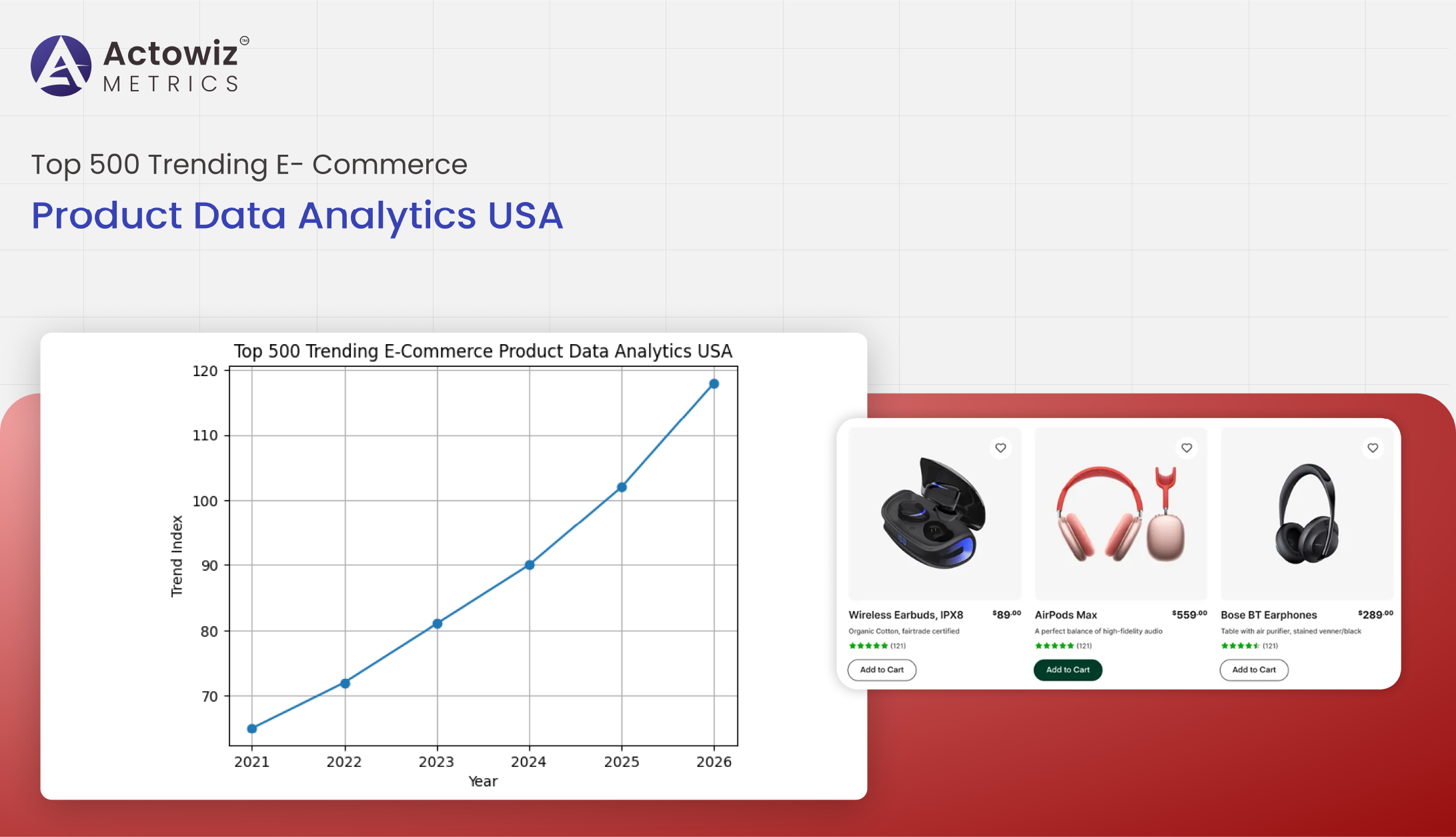

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

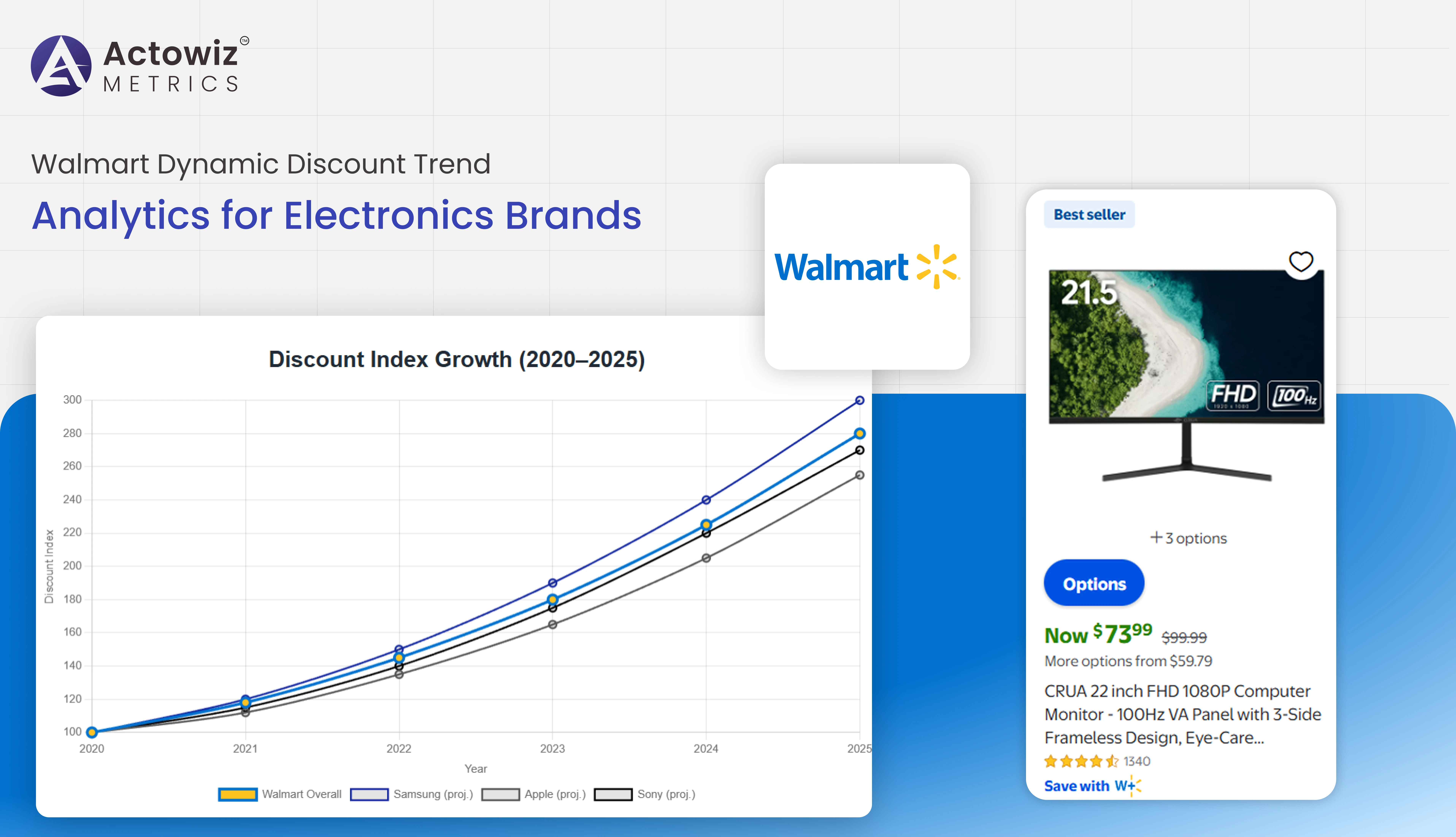

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

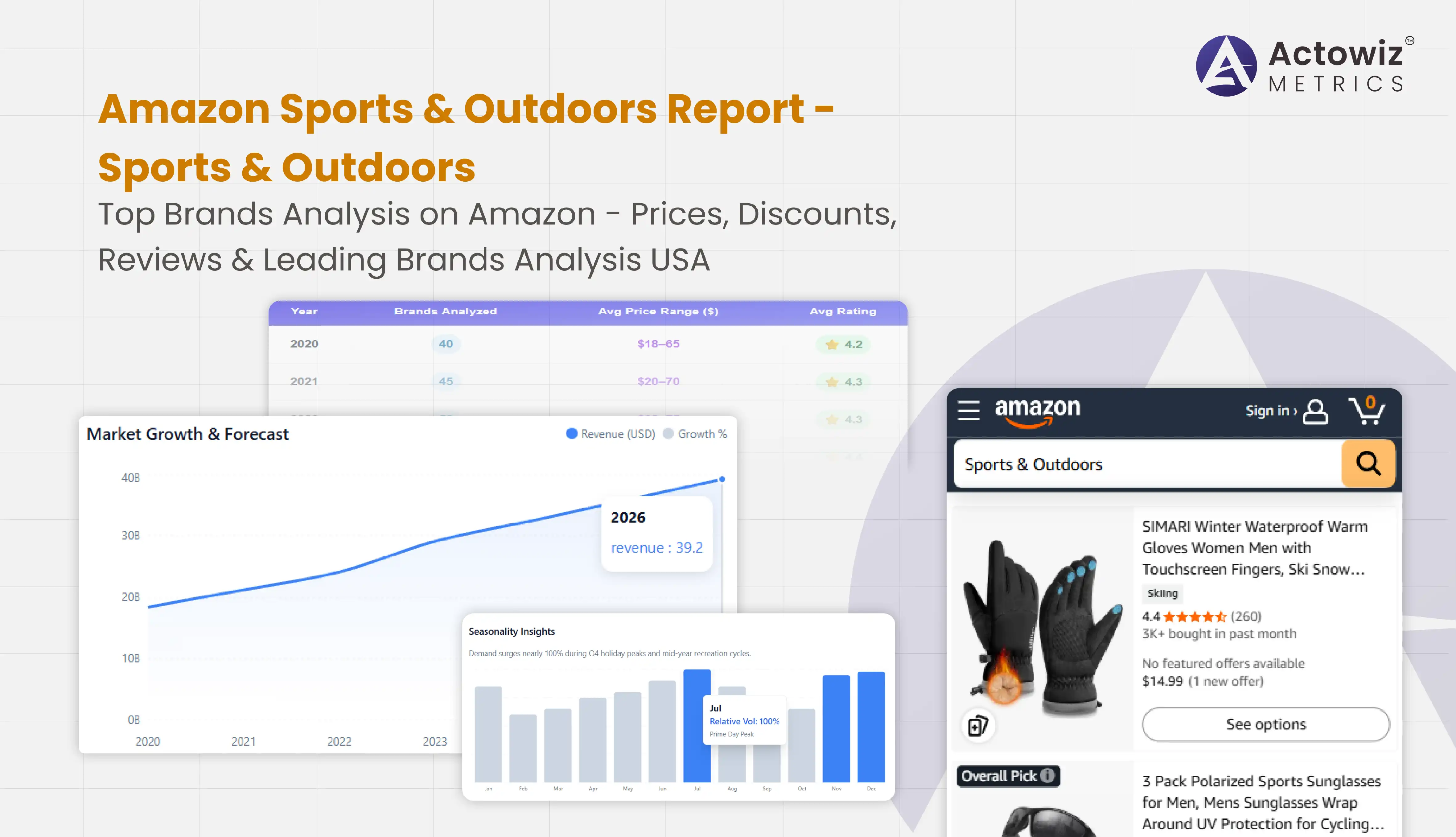

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals