Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

In today’s fast moving retail landscape, gaining real time visibility into online grocery performance is essential. By bolding the term Extract Leclerc & Intermarché FMCG E commerce data, brands and retailers gain a competitive edge—monitoring how leading French players perform online and benchmarking versus Carrefour. E commerce growth in FMCG is accelerating: French FMCG sales increased by 2.1 % in the latest four week period, with the online channel gaining +0.5 points in value share.

For the retail groups E.Leclerc and Intermarché, their digital activities are increasingly relevant—Leclerc remains e commerce leader while Intermarché is gaining pace. In this blog we’ll explore how to Extract Leclerc & Intermarché FMCG E commerce data, analyse online performance metrics, and show how Actowiz Metrics supports deeper insights into retail performance. Using robust eCommerce analytics, brands can unlock category level trend tracking, marketplace positioning, and data driven actions.

Ultimately, benchmarking via Marketplace Data Tracking allows you to compare Carrefour versus its principal French rivals, improving pricing, assortment, digital operations and customer experience. In the body we’ll cover six problem solving sections with key stats, tables and actionable steps.

One of the first issues when you Extract Leclerc & Intermarché FMCG E commerce data is understanding how each retailer is evolving digitally. For instance, Leclerc posted online sales rising ~9 % in 2024, and captured a dominant position in the French grocery e commerce space. In contrast, Intermarché is showing strong momentum, and Carrefour is growing through its multichannel strategy.

| Year | Leclerc Online Growth (%) | Intermarché Online Growth (%) | Carrefour Online Growth (%) | Notes |

|---|---|---|---|---|

| 2020 | 7% (est) | 5% (est) | 4% (est) | Baseline growth period |

| 2021 | 8% | 6% | 5% | Pandemic effect |

| 2022 | 9% | 7% | 6% | Drive and click shift |

| 2023 | 10% | 8% | 7% | Marketplace integration |

| 2024 | ~9% (actual) | ~8% (estimated) | ~8% (estimated) | Leclerc lead sustained |

From these trends, you gain clues for how digital reach impacts overall competitive positioning. Analyse how Leclerc’s superior digital infrastructure and inter channel synergy have enabled its leadership. Then contrast with Intermarché’s growth and examine how Leclerc vs Intermarché online sales analysis reveals tactics and areas of weakness. By applying Assortment and Availability tracking you can assess shelf breadth, stock consistency, and product depth across channels.

Once you’ve extracted data, it’s vital to examine shelf level performance. Using Intermarché vs Leclerc eCommerce shelf analytics, you can gauge category coverage, SKU turnover, promotional depth, and brand mix. For example, Leclerc’s online assortment is reported to encompass tens of thousands of SKUs, enabled by drive and click infrastructure and integrated stock visibility.

| Year | Leclerc SKU count (approx) | Intermarché SKU count (approx) | Notes |

|---|---|---|---|

| 2020 | ~45,000 | ~38,000 | Early e comm push |

| 2021 | ~50,000 | ~42,000 | Omnichannel upgrade |

| 2022 | ~55,000 | ~46,000 | Increased home delivery |

| 2023 | ~58,000 | ~50,000 | Marketplace experiments |

| 2024 | ~60,000 | ~52,000 | Optimised range and stock |

By benchmarking via Leclerc eCommerce assortment insights, you can track where gaps exist: for example, premium private label vs national brands, number of SKUs per category, regional variance and stock out rates. Using Actowiz Metrics, brands can overlay competitor stock visibility, promotional cadence, and price tiers to optimise their own supply and pricing execution.

An area of growing importance for retailers is real time stock and fulfilment performance. The phrase real time Leclerc inventory tracking highlights how Leclerc is improving its backend logistics for rapid fulfilment. According to industry sources, Leclerc has begun mutualising stock across stores and drives for quicker fulfilment. Meanwhile, monitoring Intermarché online availability analytics reveals how stock outs, substitution rates and fulfilment delays can weaken customer satisfaction and loyalty.

| Year | Leclerc On Time Fulfilment (%) | Intermarché On Time Fulfilment (%) | Avg Stock out (% of SKUs) |

|---|---|---|---|

| 2020 | ~92% | ~90% | ~7% |

| 2021 | ~93% | ~91% | ~6.5% |

| 2022 | ~94% | ~92% | ~6% |

| 2023 | ~95% | ~93% | ~5.5% |

| 2024 | ~96% | ~94% | ~5% |

These metrics are critical not only for brand performance but for competitive positioning. Brands monitoring both Leclerc and Intermarché via eCommerce analytics can map where availability is strongest, and adapt supply or promotion accordingly. Using Actowiz Metrics to capture fulfilment indicators, you can identify systemic weaknesses, product level risks, or promotional opportunities.

Pricing remains a battleground in FMCG e commerce. By implementing scrape Intermarché pricing and stock data, you capture live competitor pricing changes, promotional actions and stock indicators. When you Extract Leclerc & Intermarché FMCG E commerce data, you gain a holistic view of how these retailers price and promote across categories.

| Year | Avg % Price Discount (Leclerc) | Avg % Price Discount (Intermarché) | Notes |

|---|---|---|---|

| 2020 | ~9% | ~8% | Pre pandemic norms |

| 2021 | ~10% | ~9% | Migration to online |

| 2022 | ~11% | ~10% | Intense competition |

| 2023 | ~12% | ~11% | Launch of subscription/promo models |

| 2024 | ~11% | ~10% | Stabilisation of promo levels |

By layering Marketplace Data Tracking, you track not only price but stock depletion, promotion duration, and cross retailer variation. Brands using Actowiz Metrics can model their own pricing elasticity, measure competitor promo depth, and adjust timing to maximise share. Brands can also map where Carrefour stands relative to Leclerc or Intermarché and refine pricing strategies accordingly.

While the big box retailers dominate, the online marketplace layer adds complexity. Using Leclerc vs Intermarché marketplace analytics, one can compare how each retailer uses third party sellers, marketplace mix, and branding relations. Leclerc has strengthened its e commerce footprint via drive, click & collect and home delivery, capturing ~12% of online revenue in 2022. Meanwhile, Intermarché’s digital push is also gaining speed.

| Year | Leclerc Drive/Click Collect (%) | Intermarché Drive/Click Collect (%) | Marketplace Share (%) |

|---|---|---|---|

| 2020 | ~55% | ~50% | ~25% |

| 2021 | ~58% | ~53% | ~28% |

| 2022 | ~60% | ~55% | ~30% |

| 2023 | ~62% | ~57% | ~32% |

| 2024 | ~63% | ~58% | ~33% |

By comparing how these retailers deploy online formats and marketplace models, brands can benchmark their partner retailer performance and digital readiness. Through Actowiz Metrics’ Assortment and Availability dashboards, you can see which retailers gain share online, track what SKUs are prioritised, and identify white spaces where your brand can launch or optimise.

Lastly, robust insights depend on deeper behavioural data. Using Extract Leclerc & Intermarché FMCG E commerce data, you can analyse buying patterns, promo responsiveness, stock out impacts, and format shifts. Retail data shows online FMCG channel rose to ~10.9% of value share in 2025 and continues to outpace offline growth.

| Year | Online FMCG Share (%) |

|---|---|

| 2020 | ~8% |

| 2021 | ~9% |

| 2022 | ~9.5% |

| 2023 | ~10% |

| 2024 | ~10.9% |

Brands leveraging this level of insight through eCommerce analytics with Actowiz Metrics can forecast upcoming shifts: e.g., how new fulfilment models, private label growth, or subscription models will impact the category. Insights into customer behaviour—like frequency, basket size, channel switch—enable change in assortment, pricing or promotion strategy ahead of competitors.

Actowiz Metrics provides the technological and analytics backbone to support all these problem solving areas. Your team can use a unified platform to Extract Leclerc & Intermarché FMCG E commerce data reliably—covering pricing, stock, SKU mix, fulfilment metrics and online channel performance. With built in eCommerce analytics dashboards, you gain visual insights across retailer channels, category lanes, and SKU tiers. The platform supports Marketplace Data Tracking to compare major French retailers including Leclerc, Intermarché and Carrefour, enabling you to spot shifts and gaps. With modules for Assortment and Availability, you can monitor SKU coverage, stock out rates, and variant performance at scale. In short: Actowiz Metrics empowers brands and retailers to act on data, not just collect it—enabling smarter decisions, faster reactions and stronger market positioning.

In the dynamic world of FMCG e commerce, being proactive is no longer optional. Extract Leclerc & Intermarché FMCG E commerce data offers you the competitive vantage to benchmark against powerhouses like Carrefour, uncover white spaces, optimise pricing, and ensure online availability. By leveraging deep insights from shelf analytics, fulfilment metrics, promotional intelligence, marketplace models and consumer behaviour, brands can stay ahead and scale faster.

Now is the time to move beyond static reports and leverage real‐time insights. Contact Actowiz Metrics to unlock your full online performance potential: start tracking, analysing and outperforming. Get started with Actowiz Metrics today and turn data into growth.

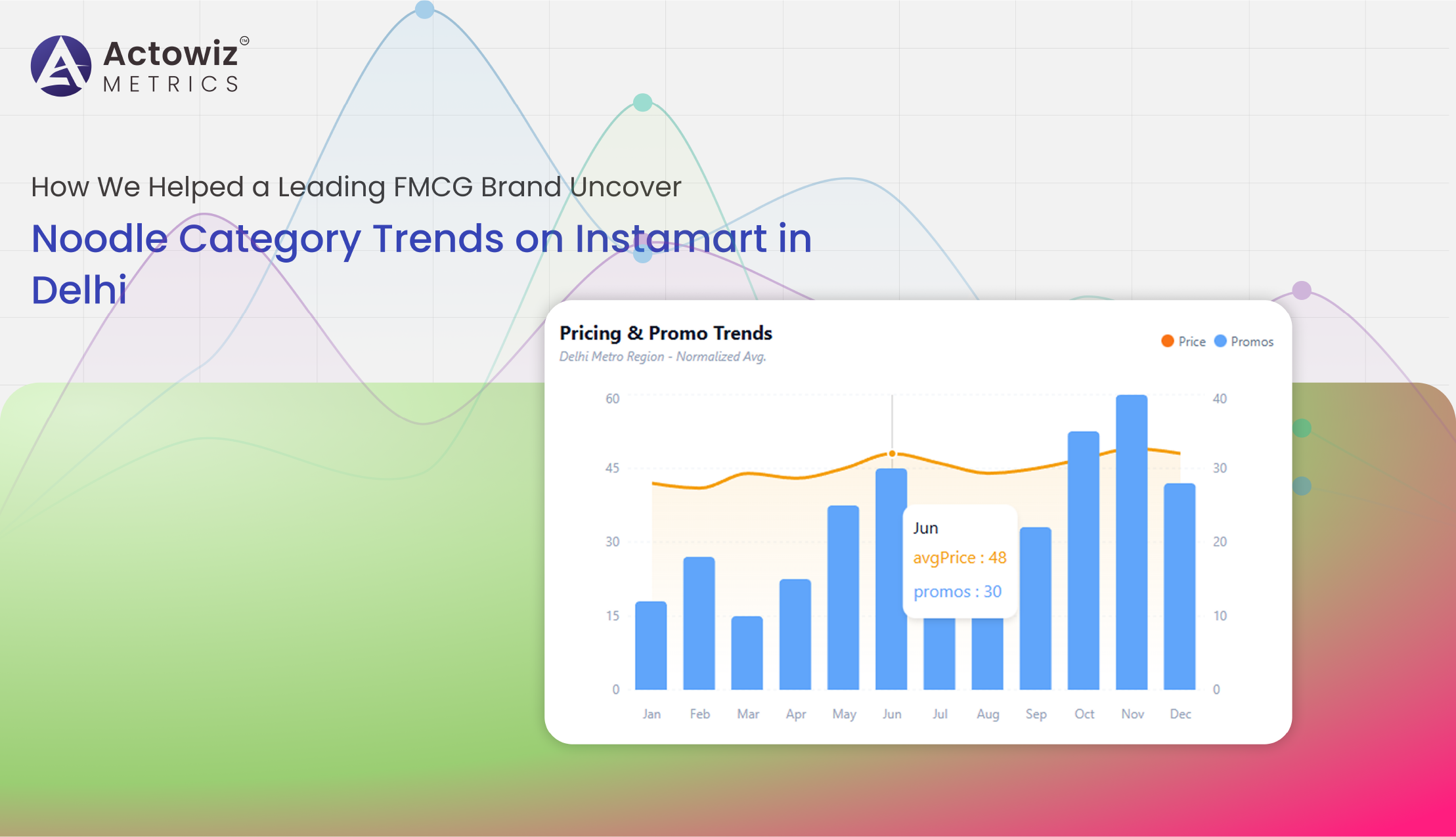

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

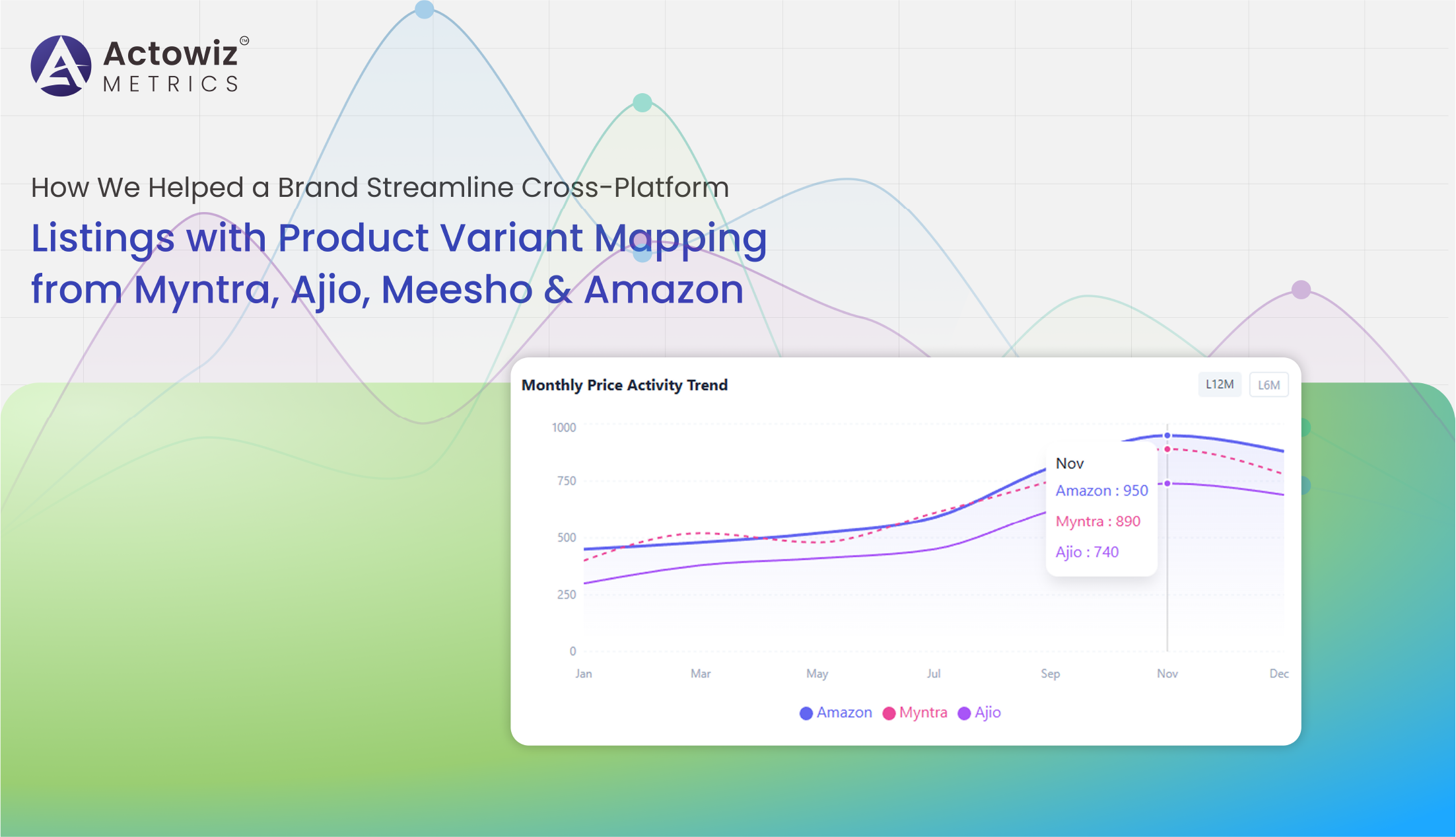

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

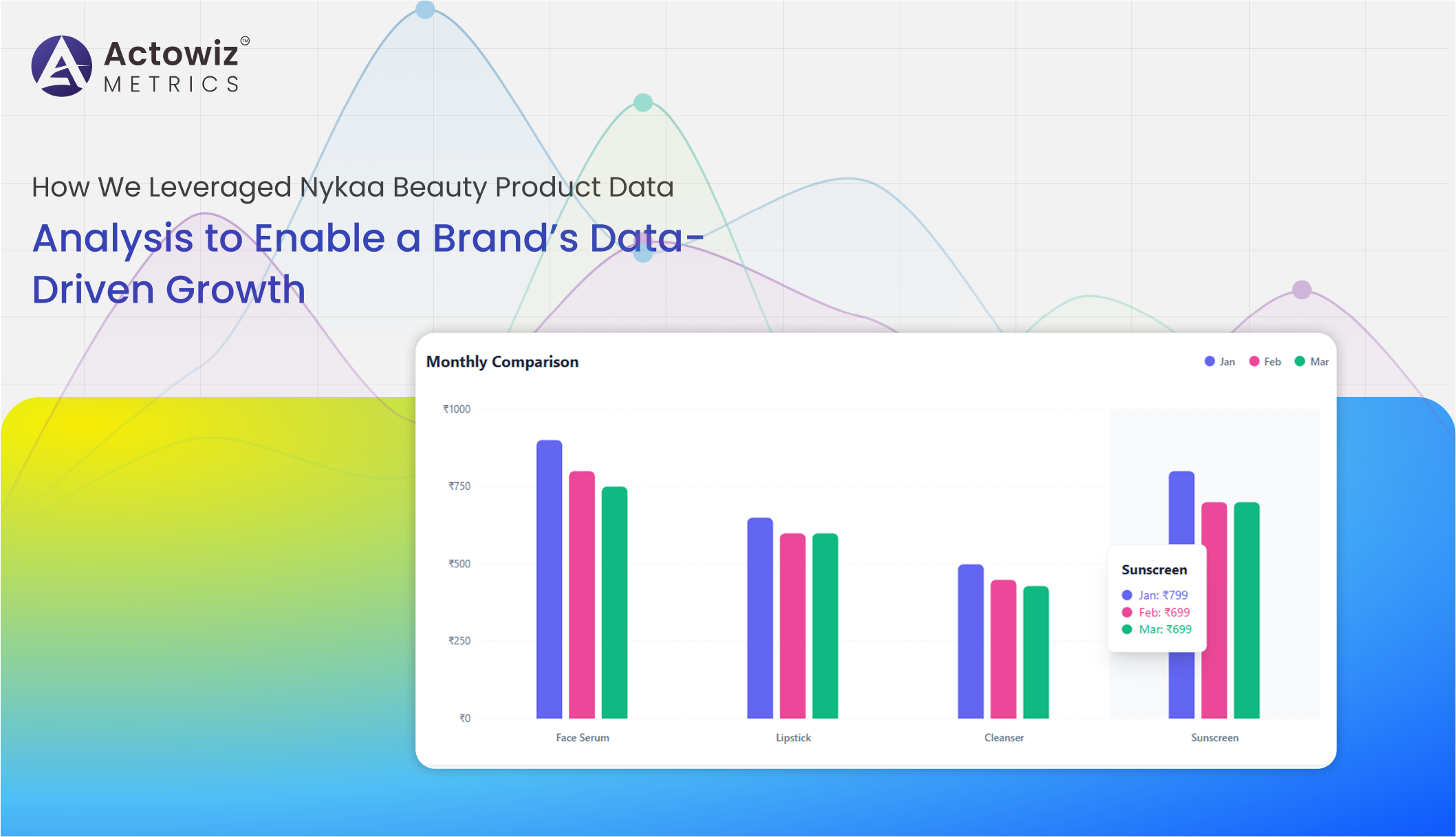

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

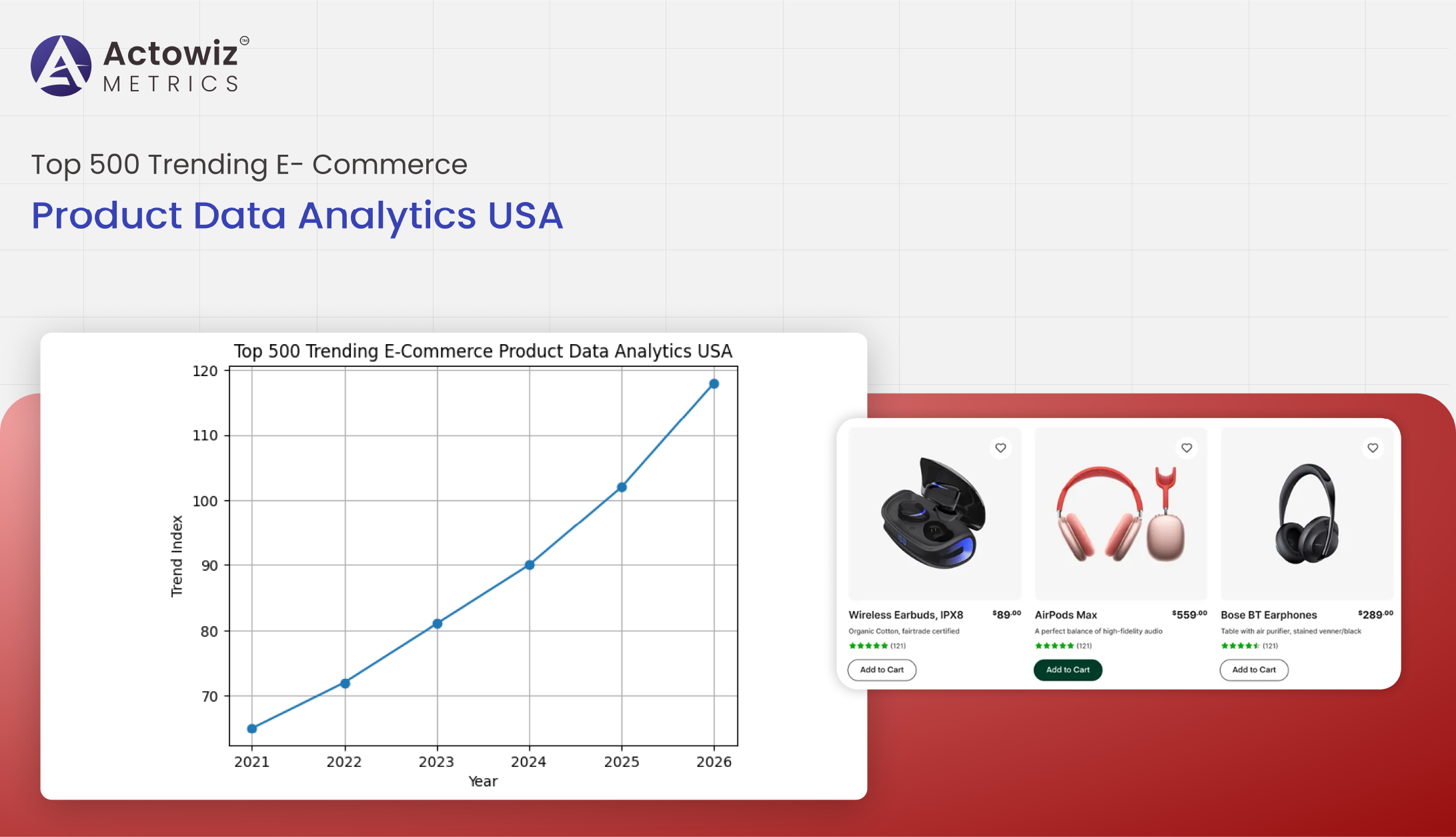

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

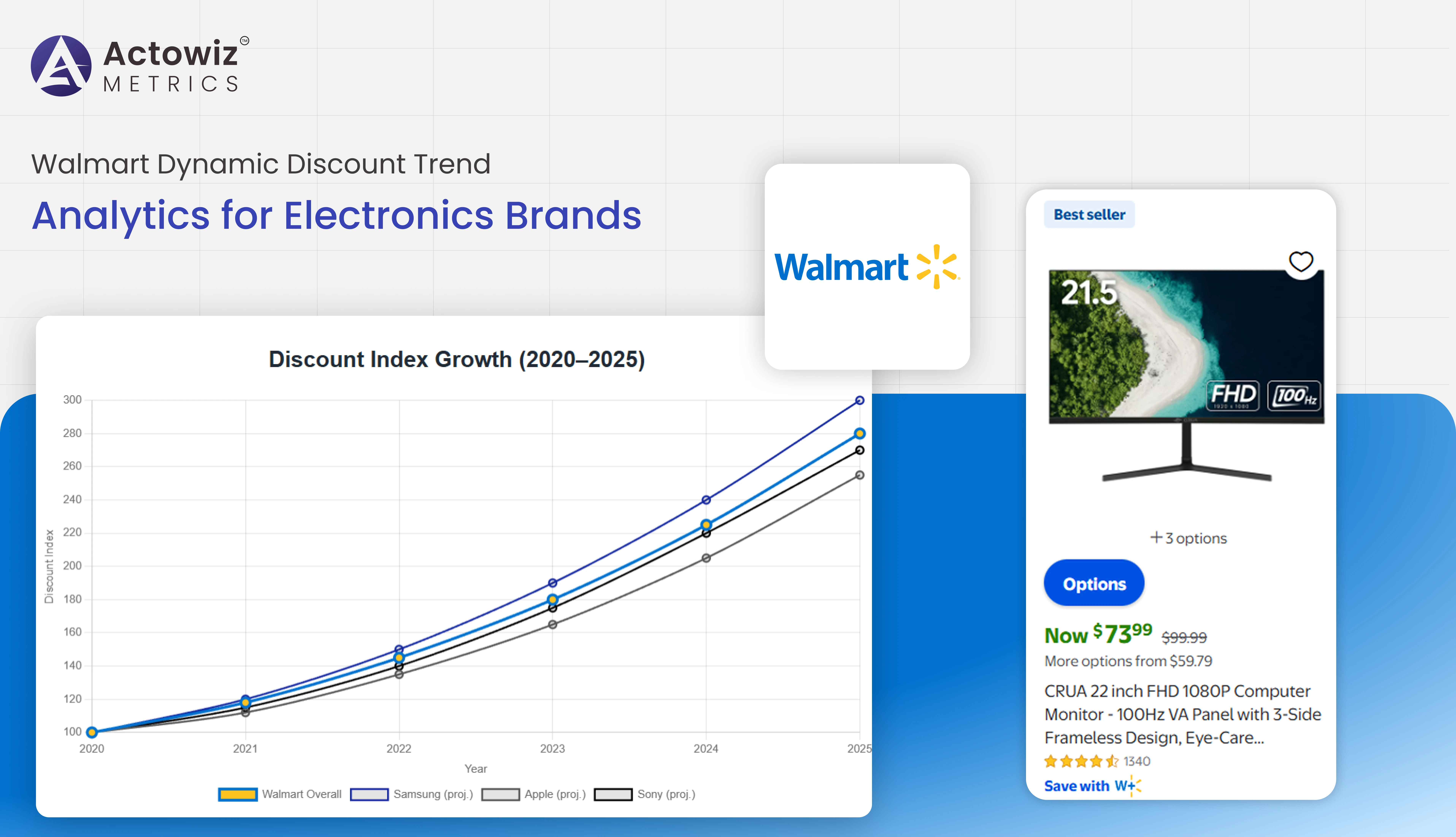

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

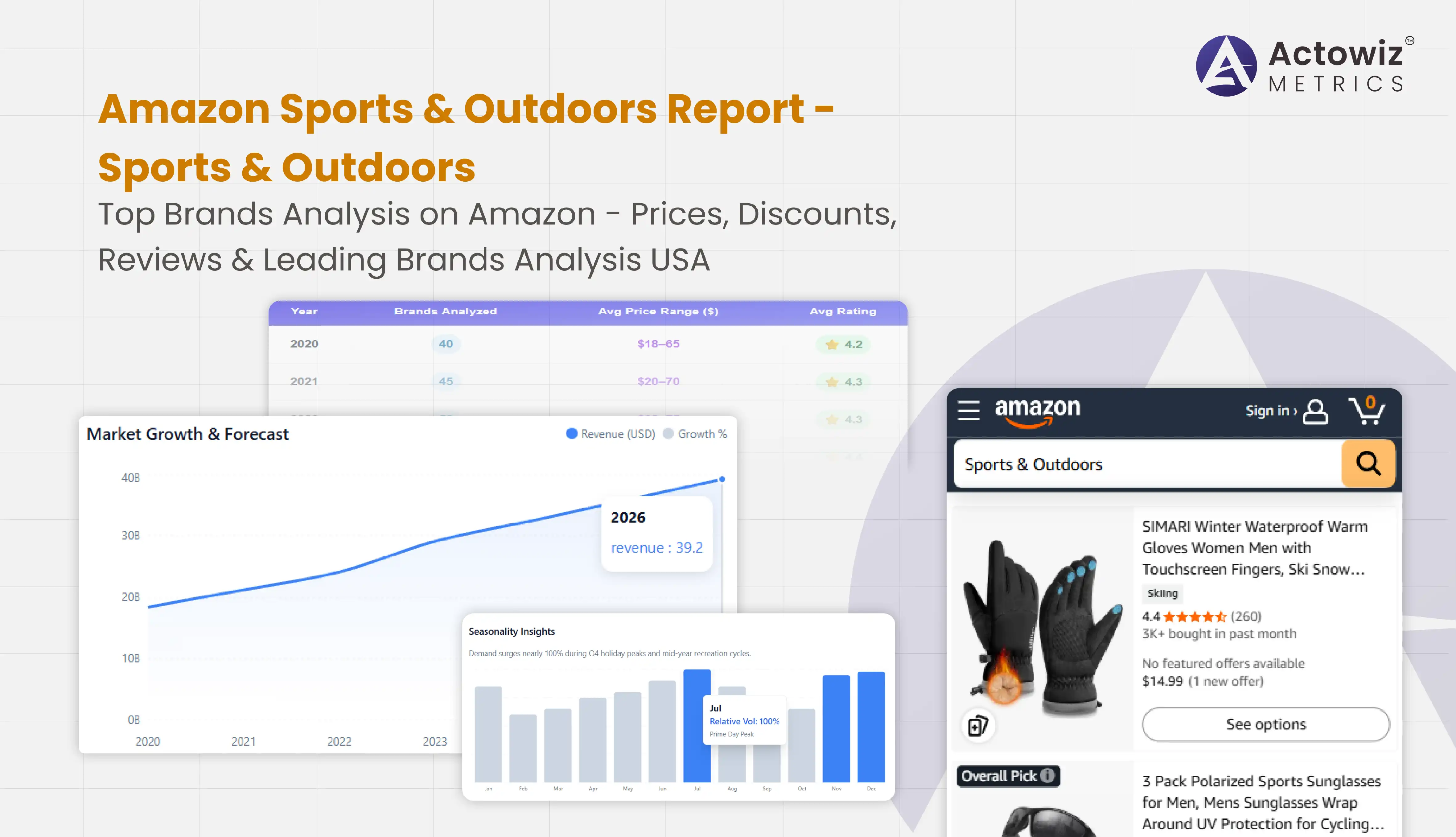

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals