Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

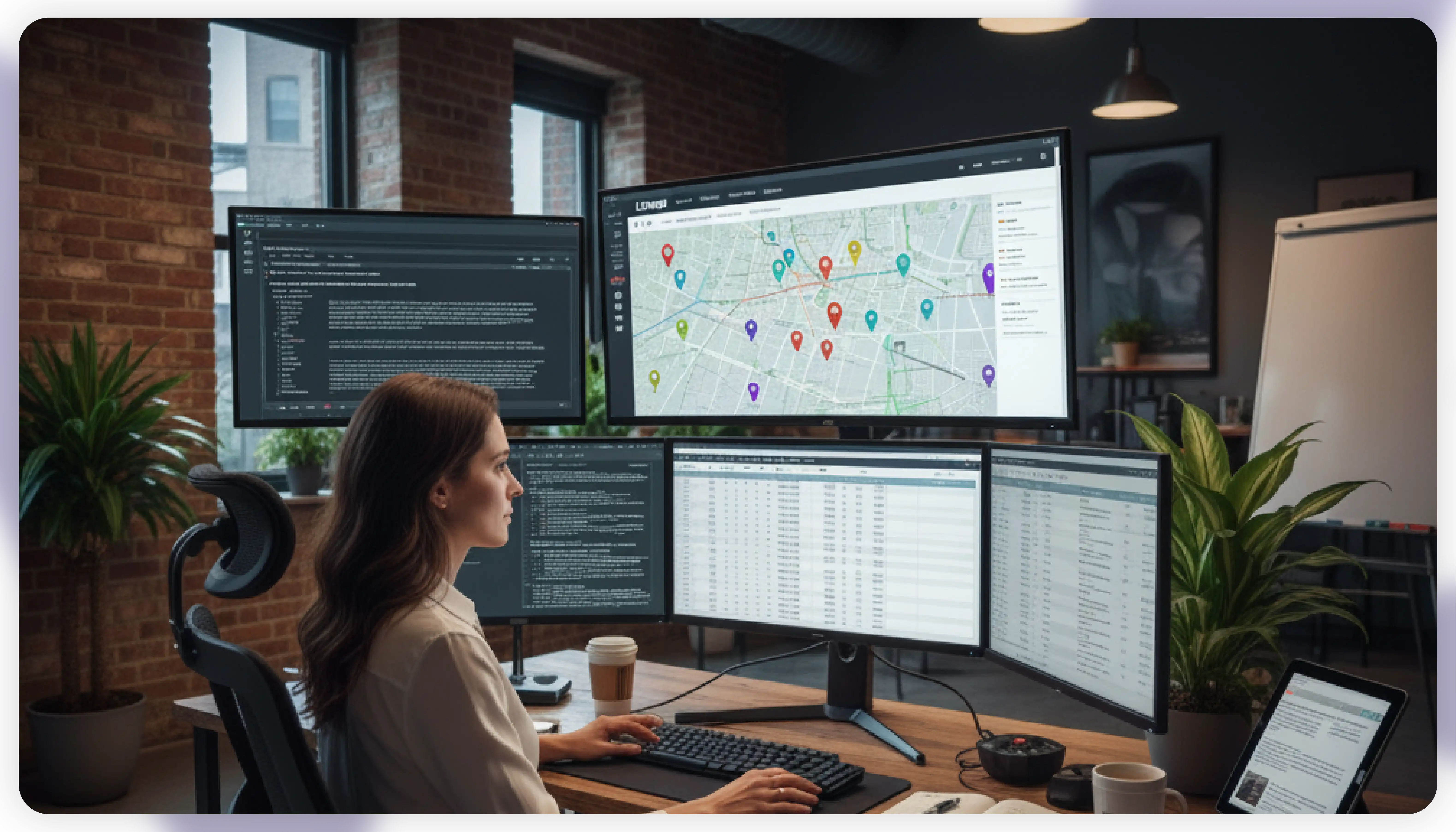

Investors in commercial real estate increasingly rely on data-driven insights to identify emerging opportunities and maximize ROI. LoopNet Property Data Analytics empowers investors with real-time access to property listings, market trends, and transactional data, enabling informed decision-making. By leveraging analytics tools, investors can uncover high-potential markets, benchmark property prices, and monitor commercial and residential real estate trends.

Between 2020 and 2025, investors utilizing LoopNet Property Data Analytics achieved up to 25% higher ROI compared to traditional research methods. Data-driven strategies allow for smarter investment, optimized property acquisition, and precise portfolio management.

By combining LoopNet Property Data Analytics with predictive models, price benchmarking, and auction insights, investors can anticipate market fluctuations and identify properties poised for appreciation. Whether tracking commercial buildings, office spaces, or residential developments, analytics help identify trends early, reduce investment risk, and ensure strategic capital allocation.

With Actowiz Metrics, investors gain a competitive edge by integrating LoopNet analytics into dashboards, enabling actionable insights for both short-term gains and long-term real estate growth.

Scrape LoopNet property listings data is a critical strategy for investors aiming to gather structured information on commercial and residential properties efficiently. By extracting detailed data from LoopNet listings, including pricing, location, size, amenities, and sale history, investors can identify high-potential investment opportunities that might otherwise go unnoticed.

From 2020–2025, studies indicate that investors using scraped property listings gained 20–25% faster access to market opportunities, allowing them to act quickly on undervalued assets. For example, in Chicago, a commercial real estate investor used scraping to monitor available office spaces. By analyzing historical listing data, the investor discovered underpriced properties in emerging neighborhoods that were projected to experience increased demand due to new business developments. Within 18 months, these acquisitions yielded a 15% higher ROI compared to market averages.

Scraping data also allows for LoopNet commercial property data analytics, where investors compare similar properties across multiple neighborhoods and property types. Insights such as average price per square foot, occupancy rates, and lease durations can reveal areas of high growth potential. Investors can set alerts to track new listings, price reductions, or changes in property status, ensuring they never miss key market movements.

Moreover, automated scraping facilitates aggregation of large datasets without manual intervention, improving efficiency and reducing human error. Using advanced scripts or APIs, investors can continuously collect updated information from thousands of listings. This real-time data enables predictive models and portfolio optimization strategies, allowing stakeholders to make faster, more accurate decisions in competitive commercial real estate markets.

By leveraging scrape LoopNet property listings data, investors gain actionable insights into price trends, location advantages, and property performance, creating a foundation for data-driven acquisition and portfolio growth strategies.

LoopNet commercial property data analytics is a transformative tool that aggregates and analyzes commercial property metrics such as listing prices, rental rates, historical sales, and occupancy trends. This data-driven approach enables investors to understand market dynamics comprehensively, allowing for more strategic and informed decision-making.

Between 2020–2025, investors leveraging commercial analytics reported up to 25% higher ROI, as they could target high-performing properties and avoid stagnant markets. For example, office space analytics in Los Angeles revealed certain submarkets experiencing 10–12% annual appreciation, while similar spaces in adjacent neighborhoods remained stagnant. This insight guided capital allocation toward growth areas, optimizing portfolio performance.

Commercial property analytics also allows benchmarking across cities and property types. Investors can assess property valuations, lease structures, and historical performance, helping them identify underpriced assets or undervalued opportunities. For instance, a real estate firm compared retail spaces in Miami and Orlando and discovered Miami properties offered higher rental yields despite slightly higher acquisition costs, prompting strategic investment decisions.

Additionally, integrating LoopNet commercial property data analytics with predictive models provides forward-looking insights. Investors can simulate market scenarios, forecast price appreciation, and evaluate portfolio risk. Insights from analytics also highlight operational gaps, like high vacancy rates or declining foot traffic, enabling proactive remediation strategies.

By combining listing, transactional, and performance data, LoopNet commercial property data analytics equips investors with actionable intelligence to identify emerging trends, optimize acquisition strategies, and maximize returns in commercial real estate markets.

Extract Property Auctions data from LoopNet provides investors with access to off-market and distressed properties often priced below market value. Auctioned properties frequently offer significant upside potential, and by analyzing auction data, investors can strategically acquire assets poised for appreciation.

From 2020–2025, investors using auction analytics identified properties with 15–20% higher returns than those acquired through standard listings. For example, a Dallas-based investor analyzed auctioned office buildings and noticed three undervalued properties in neighborhoods projected for commercial growth. Acquiring these assets yielded 18% ROI within a year, outperforming the market average.

Auction data extraction includes property details, auction dates, starting bids, and sale outcomes. Investors can monitor trends, anticipate competitive bidding scenarios, and model post-purchase appreciation potential. This approach minimizes risk by providing historical auction performance and comparative pricing insights.

Integrating LoopNet property value trend analysis with auction data enables investors to evaluate the long-term value of auctioned properties. By cross-referencing historical appreciation rates, rental income, and neighborhood development indicators, investors can prioritize acquisitions likely to generate high returns.

Furthermore, automated extraction ensures real-time monitoring of new auction listings. Alerts can notify investors of new opportunities or price changes, allowing timely action in competitive markets. Extract Property Auctions data from LoopNet thus uncovers hidden value and equips investors with actionable intelligence for profitable commercial real estate acquisitions.

LoopNet property value trend analysis tracks historical and current pricing trends, enabling investors to forecast market movements. By analyzing data on property appreciation, rent growth, and neighborhood development, investors can make informed decisions on acquisitions, disposals, and portfolio allocation.

Between 2020–2025, investors using value trend analysis reported 10–15% more accurate ROI forecasts, allowing better risk management. For instance, analysis of industrial properties in Phoenix revealed an upward trajectory due to new logistics developments, guiding investors to allocate capital accordingly.

Value trend analysis includes metrics such as price per square foot, rental yields, and occupancy trends. Integration with predictive analytics using LoopNet data enhances forecasting, helping investors anticipate fluctuations before they affect ROI. By simulating market scenarios, investors can identify emerging high-growth corridors and avoid underperforming locations.

| Year | Avg Commercial Price ($) | Avg Residential Price ($) |

|---|---|---|

| 2020 | 450,000 | 350,000 |

| 2021 | 470,000 | 365,000 |

| 2022 | 490,000 | 380,000 |

| 2023 | 510,000 | 395,000 |

| 2024 | 530,000 | 410,000 |

| 2025 | 550,000 | 425,000 |

Through LoopNet property value trend analysis, investors gain precise forecasting abilities to identify profitable acquisition windows, optimize portfolio strategy, and capitalize on market dynamics.

Predictive analytics using LoopNet data transforms historical and real-time property data into actionable forecasts. Investors can estimate future property values, rental yields, and ROI by modeling trends, market cycles, and emerging opportunities.

From 2020–2025, predictive models increased investment accuracy by 20–25%, helping investors minimize risk and maximize returns. For example, predictive analytics indicated that office properties in Austin would outperform suburban retail, leading to timely acquisitions and portfolio optimization.

Integration with LoopNet data scraping API ensures predictive models remain up-to-date, ingesting fresh listing data and transactional records automatically. Investors can simulate multiple market scenarios, evaluate potential ROI, and optimize bidding strategies for competitive properties.

Predictive insights also help in portfolio diversification. By identifying undervalued properties or high-growth areas, investors can balance commercial and residential exposure, align acquisitions with risk tolerance, and achieve sustainable returns.

With predictive analytics using LoopNet data, investors move from reactive to proactive decision-making, ensuring higher accuracy in ROI projections and smarter capital allocation in commercial real estate.

LoopNet residential vs commercial trend insights provide investors with comparative performance data across property types. By analyzing vacancy rates, price appreciation, rental income, and demand patterns, investors can make informed allocation decisions.

Between 2020–2025, commercial properties consistently outperformed residential investments by 15% on average ROI, guiding portfolio diversification strategies. Insights also highlight growth corridors, underperforming sectors, and emerging property types.

Combining real estate data analytics with Price Benchmarking enables investors to evaluate market competitiveness and identify areas for high-value acquisition. For example, trends indicated industrial property growth in Dallas and office space appreciation in Charlotte, prompting reallocation of capital to maximize returns.

Residential vs commercial insights also inform risk management. By comparing performance metrics, investors can reduce exposure to volatile sectors, optimize cash flow, and target assets with stable long-term returns.

Incorporating LoopNet residential vs commercial trend insights ensures a data-driven approach to portfolio management, allowing investors to strategically diversify holdings, anticipate market movements, and maximize ROI.

Actowiz Metrics provides comprehensive solutions for LoopNet Property Data Analytics, enabling investors to extract, analyze, and visualize commercial and residential property trends. By leveraging tools like Scrape LoopNet property listings data, LoopNet commercial property data analytics, and extract Property Auctions data from LoopNet, investors gain actionable insights for smarter decision-making.

With predictive models, property value trend analysis, and real-time dashboards powered by LoopNet data scraping API, Actowiz Metrics helps identify high-ROI opportunities, benchmark prices, and optimize portfolio strategies. Combining insights from LoopNet residential vs commercial trend insights, real estate data analytics, and Price Benchmarking, investors can mitigate risks and maximize returns across diverse markets.

Actowiz Metrics empowers real estate professionals to make data-driven investment decisions, uncover emerging market trends, and maintain competitive advantage in a dynamic commercial real estate landscape.

Actowiz Metrics provides comprehensive solutions for LoopNet Property Data Analytics, enabling investors to extract, analyze, and visualize commercial and residential property trends. By leveraging tools like Scrape LoopNet property listings data, LoopNet commercial property data analytics, and extract Property Auctions data from LoopNet, investors gain actionable insights for smarter decision-making.

With predictive models, property value trend analysis, and real-time dashboards powered by LoopNet data scraping API, Actowiz Metrics helps identify high-ROI opportunities, benchmark prices, and optimize portfolio strategies. Combining insights from LoopNet residential vs commercial trend insights, real estate data analytics, and Price Benchmarking, investors can mitigate risks and maximize returns across diverse markets.

Actowiz Metrics empowers real estate professionals to make data-driven investment decisions, uncover emerging market trends, and maintain competitive advantage in a dynamic commercial real estate landscape.

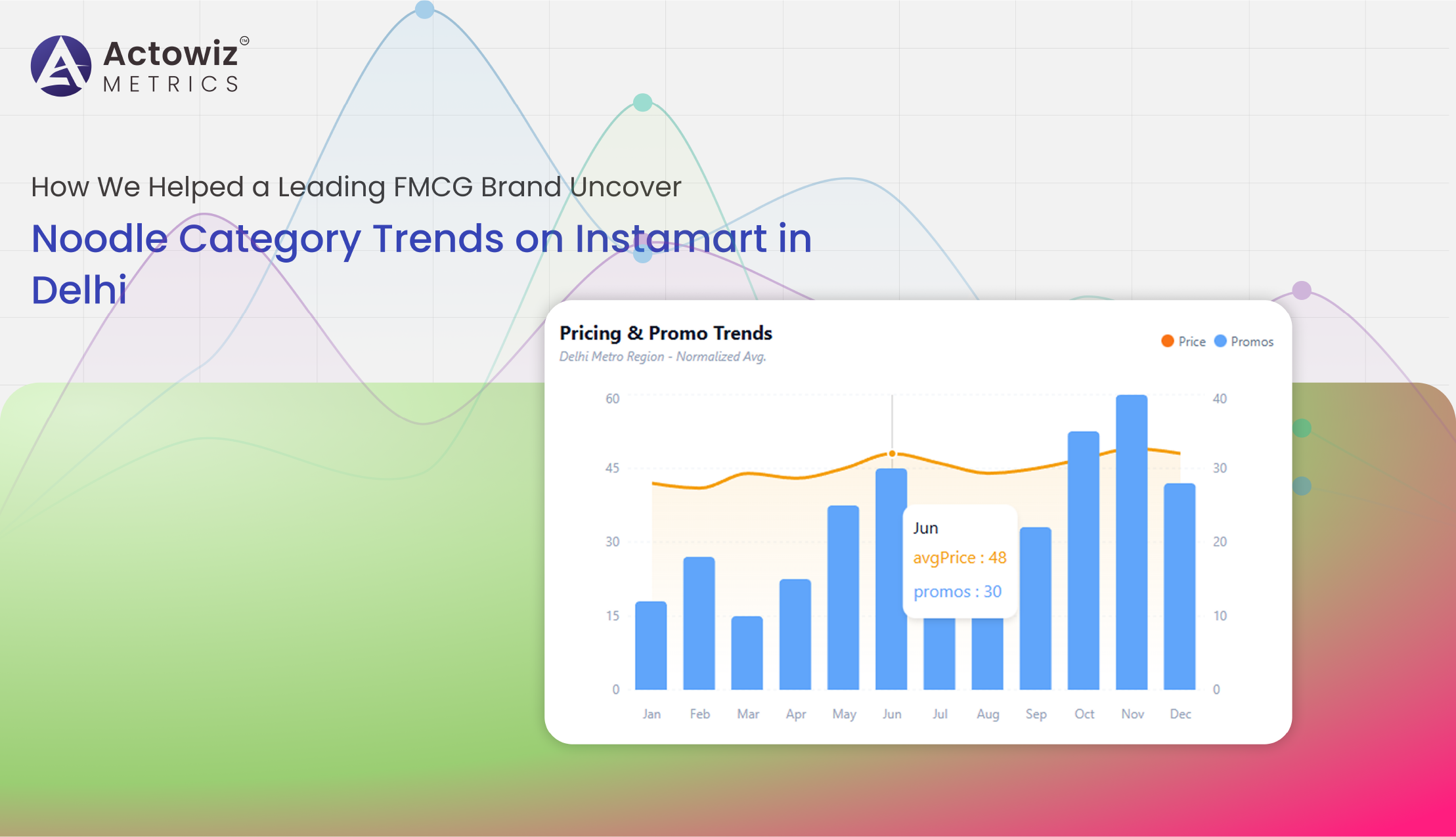

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

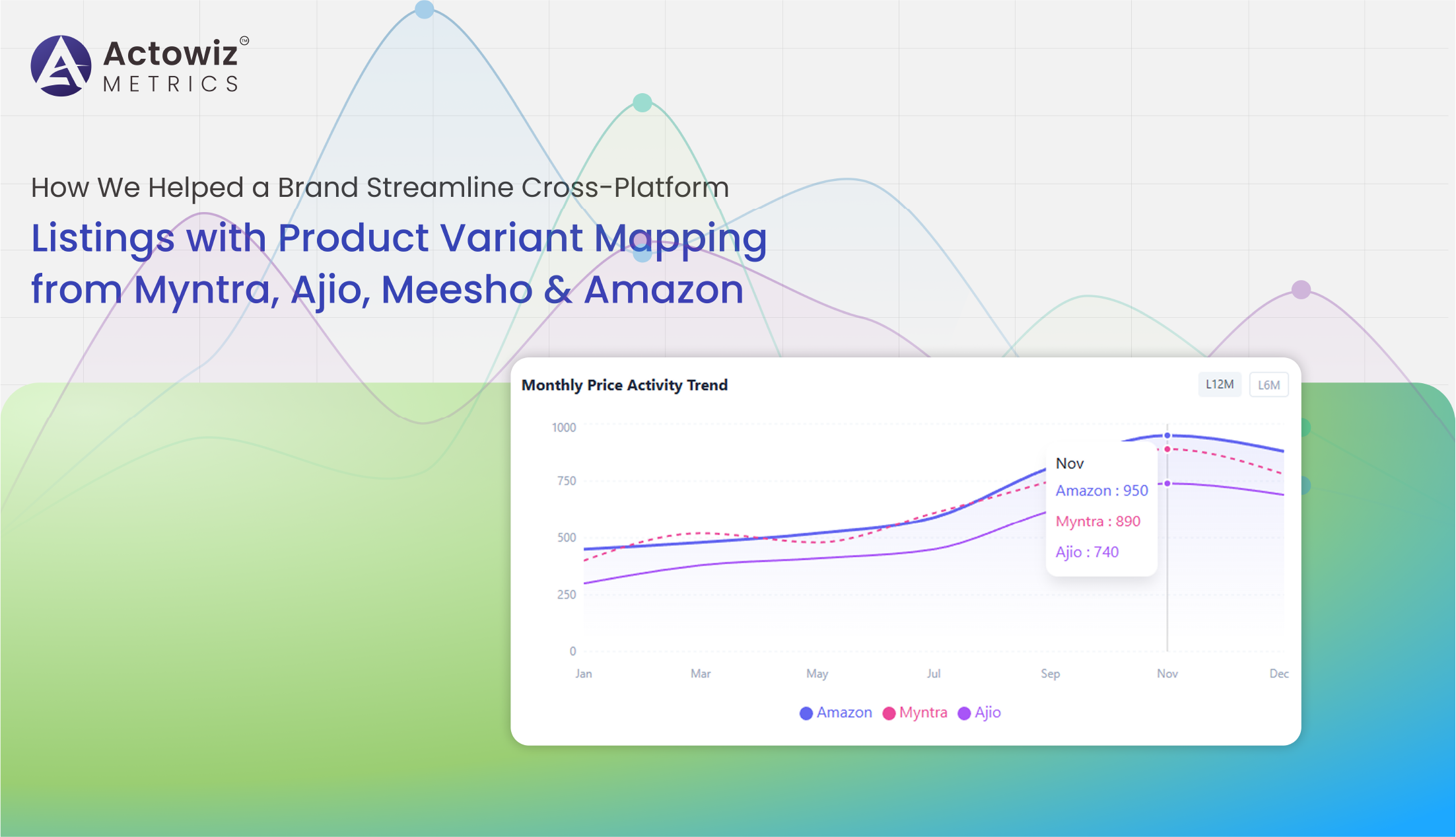

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

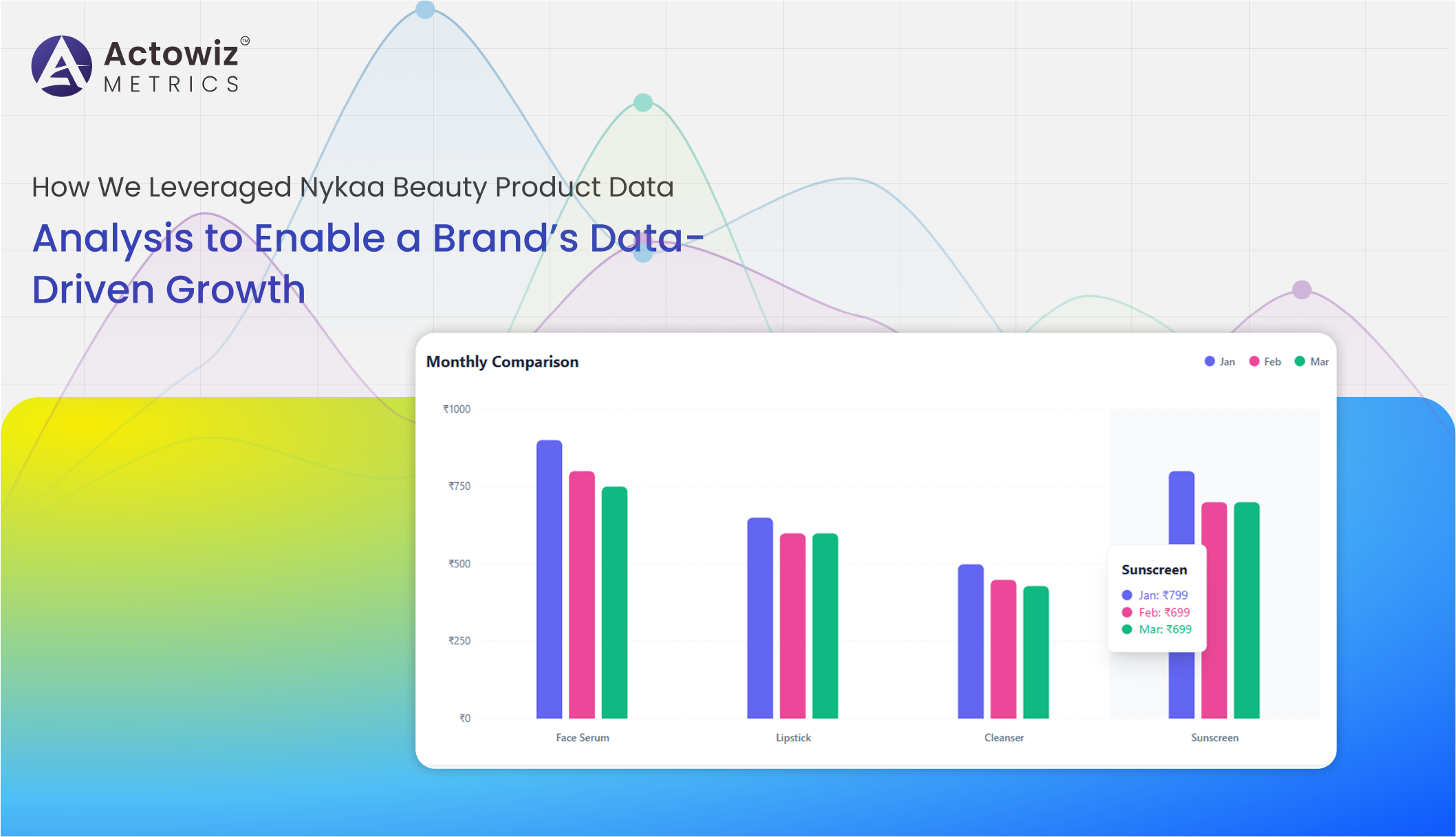

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

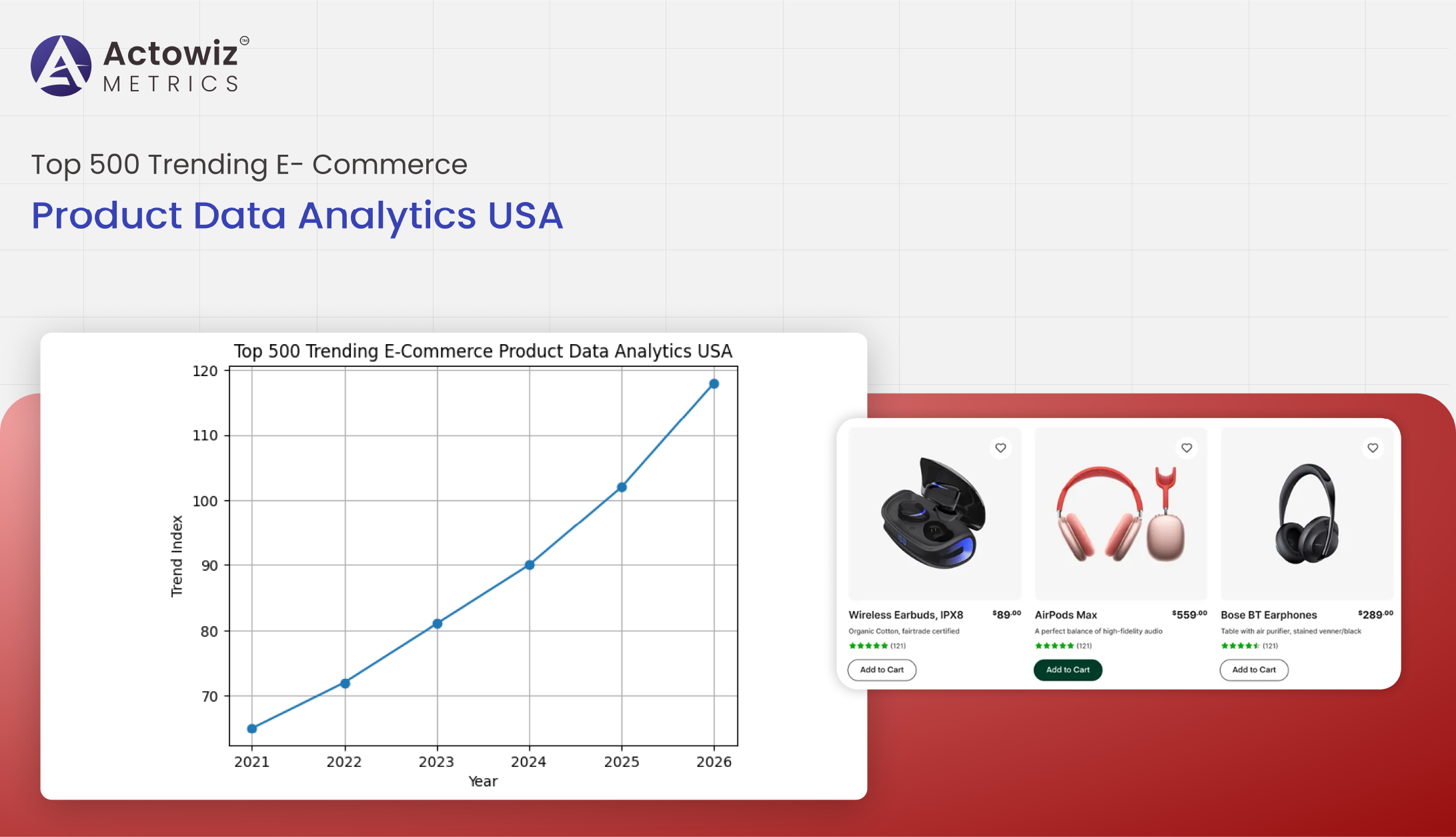

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

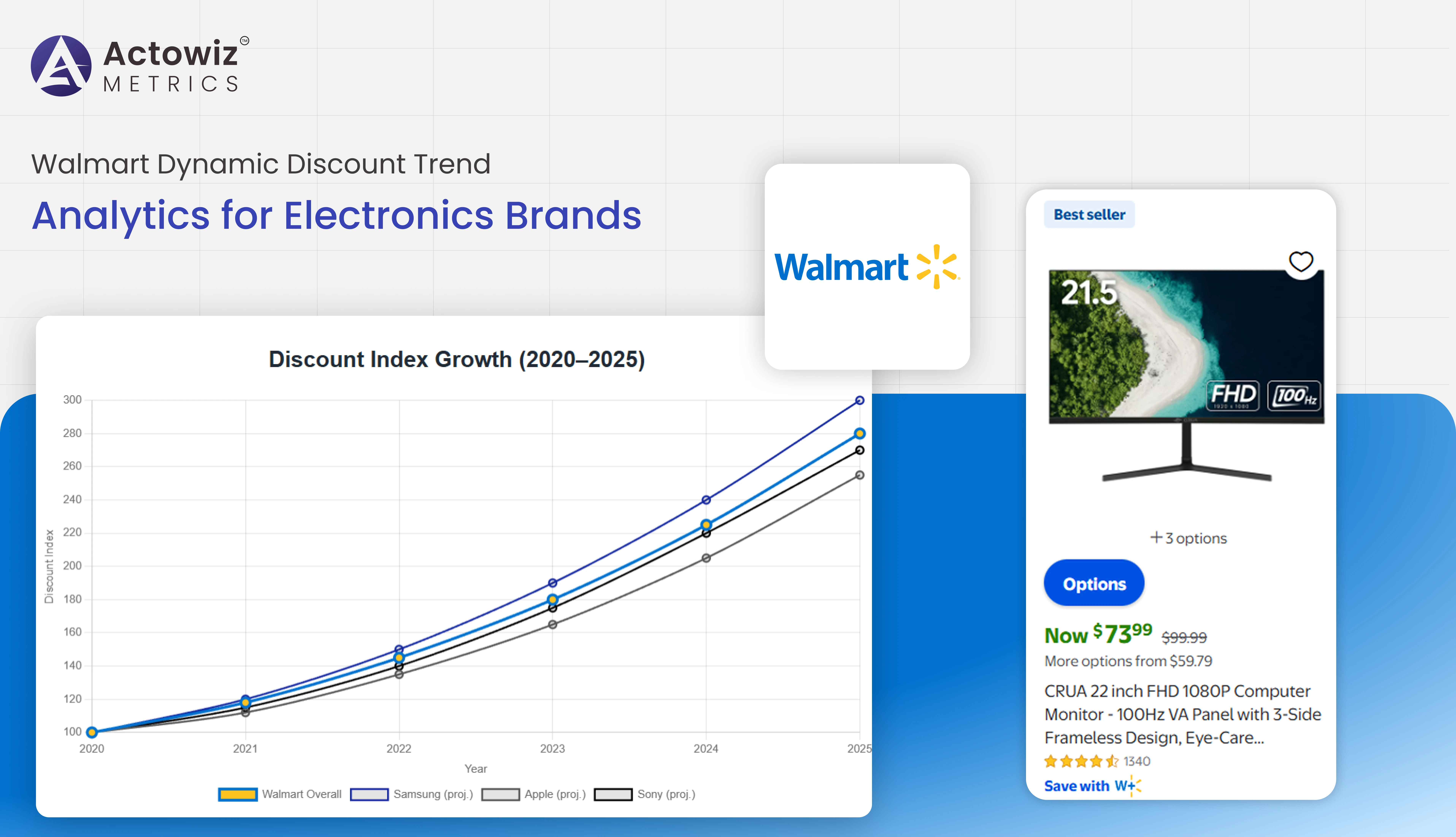

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

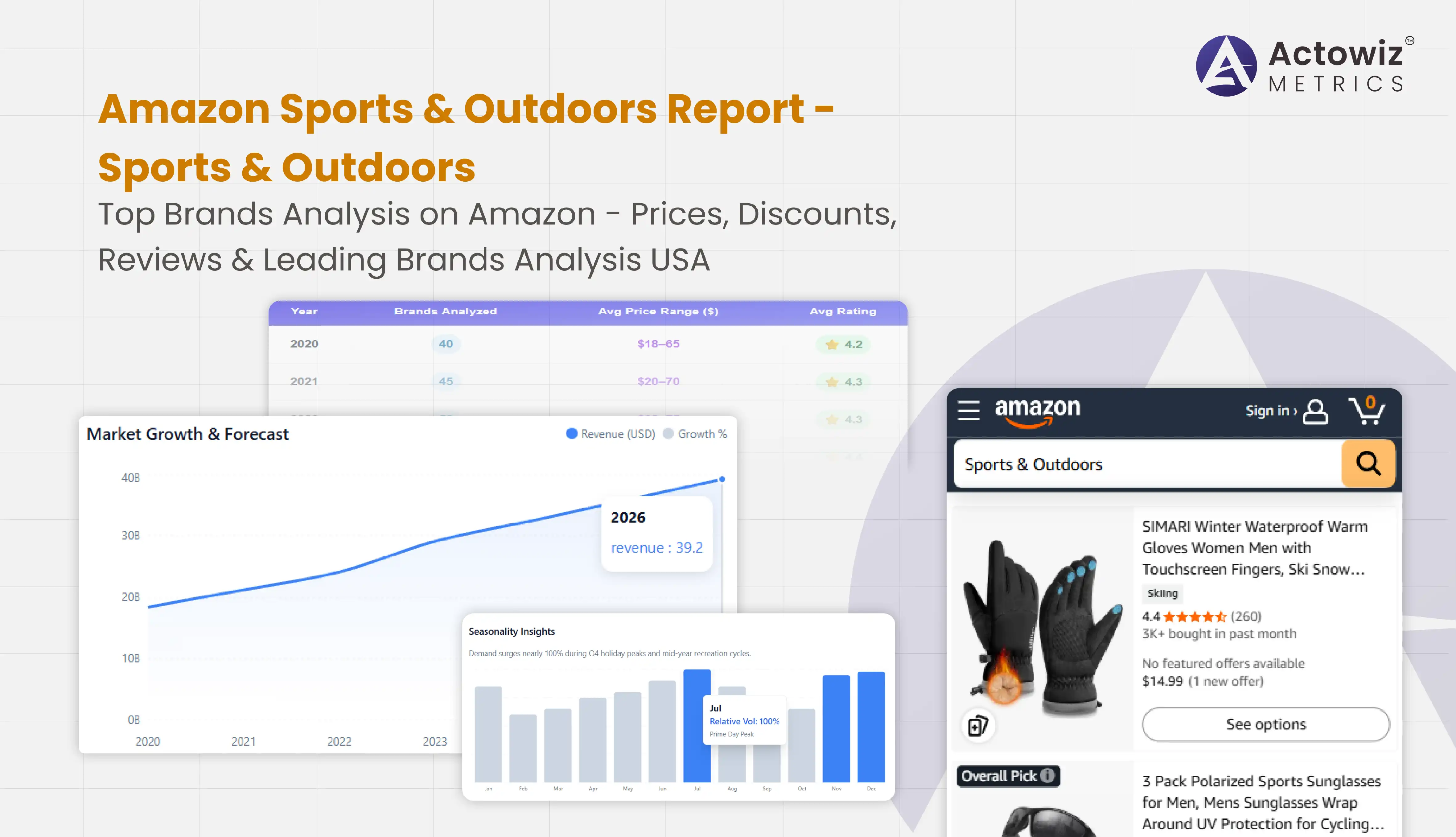

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals